boxblog.ru

Overview

Sep Ira Advantages

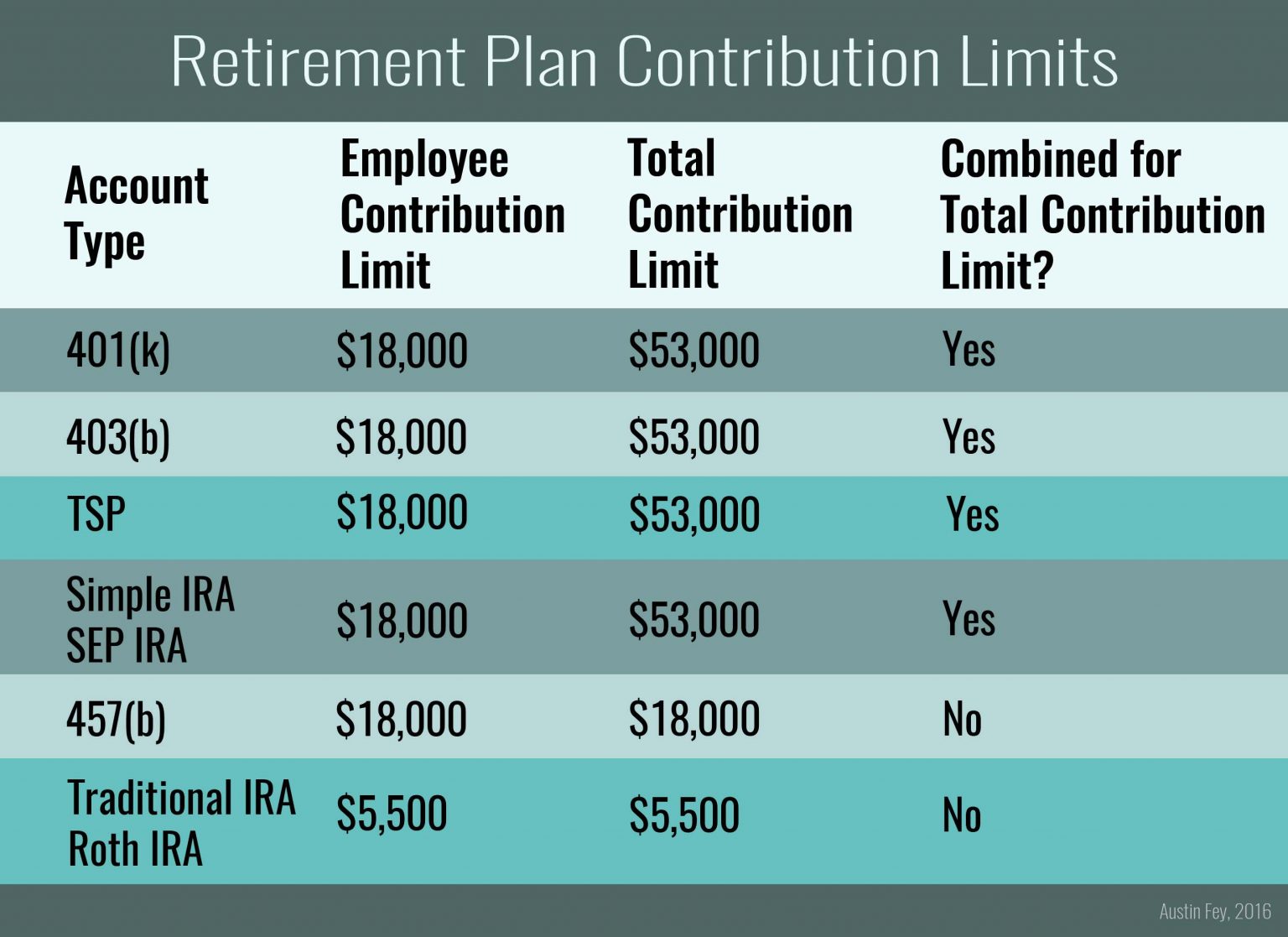

Interest earned in a SEP IRA grows tax-deferred. Dividends and investment earnings continue to grow without being taxed until you withdraw the assets. Other Key Advantages · No complicated forms to fill out · No annual reports for you to file with the IRS · Contributions are not mandatory each year · Ability to. A SEP is easier to set up and has lower operating costs than a conventional retirement plan and allows for a contribution of up to 25 percent of each employee'. SEP stands for Simplified Employee Pension. Being one of the best pension plans in India, it allows employers and self-employed individuals to make tax-. Easy setup. A SEP plan is like a “corporate IRA” established by an employer for the benefit of each employee. · Tax advantages · Minimal administrative costs. The tax consequences of SEP IRAs are an essential component of retirement planning. Employer contributions are often tax deductible, which provides an excellent. What are the benefits of a SEP IRA? · Tax-deductible contributions that vest immediately · Tax-deferred earnings · Flexible annual contributions · High. SEP IRA tax advantages. SEP IRA accounts grow tax-deferred. Your initial contributions to your SEP IRA are tax-deductible, potentially reducing your taxable. A SEP IRA is a retirement plan option for small business owners and qualified employees. It has higher contribution and income limits than other retirement. Interest earned in a SEP IRA grows tax-deferred. Dividends and investment earnings continue to grow without being taxed until you withdraw the assets. Other Key Advantages · No complicated forms to fill out · No annual reports for you to file with the IRS · Contributions are not mandatory each year · Ability to. A SEP is easier to set up and has lower operating costs than a conventional retirement plan and allows for a contribution of up to 25 percent of each employee'. SEP stands for Simplified Employee Pension. Being one of the best pension plans in India, it allows employers and self-employed individuals to make tax-. Easy setup. A SEP plan is like a “corporate IRA” established by an employer for the benefit of each employee. · Tax advantages · Minimal administrative costs. The tax consequences of SEP IRAs are an essential component of retirement planning. Employer contributions are often tax deductible, which provides an excellent. What are the benefits of a SEP IRA? · Tax-deductible contributions that vest immediately · Tax-deferred earnings · Flexible annual contributions · High. SEP IRA tax advantages. SEP IRA accounts grow tax-deferred. Your initial contributions to your SEP IRA are tax-deductible, potentially reducing your taxable. A SEP IRA is a retirement plan option for small business owners and qualified employees. It has higher contribution and income limits than other retirement.

(k) Advantages over SEP and SIMPLE IRAs ; Vesting timing for employer contributions, Multi-year options or immediate. Immediate ; Access to funds before age. What are the advantages for employees? Designed specifically for self-employed individuals and small business owners, a Schwab SEP-IRA provides a low-cost and easy way to contribute toward your. Voya can help you set up a SEP plan for your small business, and serve as the IRA custodian holding assets for each employee. Key Features. A SEP IRA — short for simplified employee pension plan — is a tax-advantaged retirement plan designed for business owners. A SEP IRA provides greater flexibility and is less cumbersome than its (k) counterpart, making it a strong alternative for employers eager to attract and. SEP IRAs also come with tax benefits. For employers, all contributions made are tax deductible. For employees, there is the benefit of growling tax-deferred. Advantages of a SEP. ▫ Contributions to a SEP are tax deductible and In other words, you can contribute to a SEP-IRA on your own behalf. The term. Simplified Employee Pension Plans (SEP IRAs) help self-employed individuals and small-business owners get access to a tax-deferred benefit when saving for. Disadvantages of a SEP-IRA. The disadvantages of a SEP-IRA include: Absence of Catch-Up Contributions: For individuals approaching retirement, SEP-IRAs do not. SEP IRA benefits: · Typically, higher annual contribution limits than standard IRAs or (k)s. · Contributions are immediately % vested and grow tax-deferred. Simplified Employee Pension Plan (SEP). · SIMPLE IRA Plan. · COLA Increases for Dollar Limitations on Benefits and Contributions. · Retirement Topics - SIMPLE IRA. Benefits for employers: · No plan fees at the employer level · Employer contributions are tax deductible for the business · Employers can determine how much to. SEP-IRA contribution limits · You can contribute up to 25% of your total compensation or a maximum of $66,0tax year or $69, for the tax year. The advantage presented by higher contribution limits comes with an important caveat for business owners with employees. If you set up a SEP IRA for yourself. Tax-deductions – Contributions to SEP retirement accounts are tax-deductible to the company, and the company pays no taxes on the earnings inside those SEP IRAs. Unlike a SIMPLE IRA, into which employee contributions are made, in a SEP IRA, only the employer makes contributions to the account. They are ideal for self-. SEP Benefits ; Easy to manage. Minimum amount of record keeping required ; Tax benefits. Self-employed individuals can fully deduct contributions ; Higher. What Are the Advantages of a SEP IRA? A SEP IRA is easy to set up and operate, and does not have annual fees or setup costs. Flexible annual contributions. Designed specifically for self-employed individuals and small business owners, a Schwab SEP-IRA provides a low-cost and easy way to contribute toward your.