boxblog.ru

Overview

How To Freeze Bank Account

Yes. The bank may temporarily freeze your account to ensure that no funds are withdrawn before the error is corrected, as long as the amount of funds frozen. Learn how to place a credit freeze. This prevents any new credit accounts from being created in your name and helps prevent identity theft. No. You typically can't fully freeze an account unless suspected/confirmed fraud for most banks. Some banks will let you lock card access. You can do this in our app · If you're struggling with a spending habit, you can freeze specific transactions such as gambling or online and remote purchases. No. You typically can't fully freeze an account unless suspected/confirmed fraud for most banks. Some banks will let you lock card access. A bank may freeze an account as a result of a creditor's request for judgement against the account holder. For any outstanding taxes or student debts, the. You should consider placing a Security Freeze on your consumer file at ChexSystems. This is the system most banks use to verify your identity when opening a. Enroll in our Online Banking and get easy and secure access to your accounts—anytime, anywhere. Check account balances and transactions, transfer funds between. Using the Mobile Banking app or Online Banking: Go to Menu; Select Manage Debit Card/Credit Card; Select the card you want to manage; Select to Lock or Unlock. Yes. The bank may temporarily freeze your account to ensure that no funds are withdrawn before the error is corrected, as long as the amount of funds frozen. Learn how to place a credit freeze. This prevents any new credit accounts from being created in your name and helps prevent identity theft. No. You typically can't fully freeze an account unless suspected/confirmed fraud for most banks. Some banks will let you lock card access. You can do this in our app · If you're struggling with a spending habit, you can freeze specific transactions such as gambling or online and remote purchases. No. You typically can't fully freeze an account unless suspected/confirmed fraud for most banks. Some banks will let you lock card access. A bank may freeze an account as a result of a creditor's request for judgement against the account holder. For any outstanding taxes or student debts, the. You should consider placing a Security Freeze on your consumer file at ChexSystems. This is the system most banks use to verify your identity when opening a. Enroll in our Online Banking and get easy and secure access to your accounts—anytime, anywhere. Check account balances and transactions, transfer funds between. Using the Mobile Banking app or Online Banking: Go to Menu; Select Manage Debit Card/Credit Card; Select the card you want to manage; Select to Lock or Unlock.

Another way to avoid having one's accounts frozen is to place the account in a revocable trust. This allows the original account holder to retain control of the. Why would a creditor freeze your bank account? Your bank account can be frozen when you are sued, lose the lawsuit, and receive a judgment against you. This. A creditor is attempting to get a business debt paid by freezing my bank account to take my retirement funds, and it's. Lawyer's Assistant chat img. Customer: A. Private creditors and debt collectors cannot freeze your account to pay certain court judgments* (and your bank or credit union cannot charge a restraining. In order to process an account freeze, banks and investment firms must first receive a court order. At that point, the financial institution it is legally. To place, lift or remove a security freeze for a Protected Consumer, please submit your request in writing and provide sufficient proof of authority and. Banks can freeze your account if they've spotted illegal activity on it or if you owe a debt to a creditor or the government and the court ordered a judgment. A creditor or debt collector cannot freeze your bank account unless it has a judgment. Judgment creditors freeze people's bank accounts as a way of pressuring. Freeze your debit card using online banking. To freeze your debit card in online banking, all you need to do is: Log in to online banking; Select 'Cards' from. Individual bank account customers can freeze their own checking accounts using one of a variety of banking holds. Typically, deposits continue to come in. Most creditors must file a lawsuit and get a judgment against you before freezing your bank account. If the creditor wins the suit, the court issues a money. It is unfortunately entirely legal for creditors to freeze bank accounts as long as they have a judgement against the debtor. A creditor or debt collector cannot freeze your bank account unless it has a judgment from the court. Judgment creditors freeze people's bank accounts as a way. Step 1. From the Accounts page, select the corresponding checking account to freeze your debit card, or select the credit card you want to. When a bank freezes your account, it can mean there is something wrong with your account or that someone has a judgment against you to collect on an unpaid debt. A bank account can be frozen through an attorney's office without court approval. A creditor who holds a valid New York judgment can freeze or restrain assets. Freeze your card. For Personal and Business. If your debit card is lost or stolen, you can freeze it from our app or online banking to help prevent unwanted. Creditors can freeze the amount owed to them in a debtor's bank account located in the EU, if there is a risk that the enforcement of their claim would be. If you have unpaid debts to a credit card company or other financial institutions, your creditors may get the bank to freeze your account. While. Misplaced your debit card? You can freeze your card using our app or online banking so it can't be used until you find it again.

Business Billing Software

Invoicing software can create invoices, help with expense tracking, and process online payments. Online invoicing tools let you focus on running other business. Xero. Best for small businesses. day free trial; From $15/user/month, (billed annually). FreshBooks Invoice is invoicing software designed for small businesses. Grow your business with the best online invoice software. Best billing software to securely manage and create invoices. Compare top online billing software by pricing, features, and user. Free Invoicing Software for small business creates customized invoices in less than 2 minutes. Sign up now for effortless online/ offline invoicing. Manual invoice processing methods have long been the practice of businesses. Automation through the use of invoicing software, however, has introduced a. Online billing software creates and tracks invoices in real-time, automates reminders, handles recurring invoicing, and enhances faster payment processing. From adding your company logo to changing fonts, customize invoice templates to reflect your brand. Multiple Payment Methods - Billing and Accounting Software |. invoicely is free online invoicing for small businesses. Create and send invoices and estimates, track time and expenses and accept online payments. Invoicing software can create invoices, help with expense tracking, and process online payments. Online invoicing tools let you focus on running other business. Xero. Best for small businesses. day free trial; From $15/user/month, (billed annually). FreshBooks Invoice is invoicing software designed for small businesses. Grow your business with the best online invoice software. Best billing software to securely manage and create invoices. Compare top online billing software by pricing, features, and user. Free Invoicing Software for small business creates customized invoices in less than 2 minutes. Sign up now for effortless online/ offline invoicing. Manual invoice processing methods have long been the practice of businesses. Automation through the use of invoicing software, however, has introduced a. Online billing software creates and tracks invoices in real-time, automates reminders, handles recurring invoicing, and enhances faster payment processing. From adding your company logo to changing fonts, customize invoice templates to reflect your brand. Multiple Payment Methods - Billing and Accounting Software |. invoicely is free online invoicing for small businesses. Create and send invoices and estimates, track time and expenses and accept online payments.

You can use invoice software to create and customize invoices for your business. Top invoice programs also facilitate billing and payment by integrating with e-. Zoho Invoice is the way to go for small biz invoicing. It's totally free with all the must-have features. You can make custom invoices, set up. Invoicing software for small business · Create professional, customizable invoices. Add your company name and logo, choose your currency and set multiple tax. A billing system, meaning the process of invoicing and billing customers by using billing software, includes automating payment collection, issuing invoices. Tools to run your business, invoice clients & get paid. Projects, Tasks, Time-Tracking. FreshBooks invoicing software helps small businesses save time by simplifying the billing process. The invoice generator helps you create professional-looking. Invoicing software helps businesses and entrepreneurs create, send and track professional-looking invoices. These invoices will contain a detailed list of. Business bookkeeping includes both accounts payable (money that your business owes to vendors and B2B service providers) and accounts receivable (the cash. Rated as top billing software for small businesses, this invoicing Software is a bit affordable and efficient. Expense registration ✓ Stock management. Boost your business efficiency with our user-friendly online invoicing and billing software, trusted by 4 million users. Try it for free now. Square Invoices is a secure, all-in-one invoicing software. It streamlines the process of requesting, tracking, and managing invoices, estimates, and payments. Invoicing software for small businesses and freelancers. Using Wave saves you time, gets you paid, and makes managing customer information stress-free. Tipalti · Zoho Billing · TimeSolv · NetSuite · Xero · AvidXchange · Paystand · Zoho Books. Organizations may use billing software to make it easier to charge consumers for the products and services they have received. Businesses utilize a variety of. Invoicing software for small business · Create professional, customizable invoices. Add your company name and logo, choose your currency and set multiple tax. In this article, we cover what invoicing software can do, the different types available, and leading options for small businesses. Invoice Your Customers in Seconds. The world's simplest way to invoice customers, from your phone or laptop. Save time, stay organized and look professional. For example, FreshBooks excels at invoicing and helps service-based businesses, while Sage is widely used in the construction industry. Consider your industry. A do-it-all invoicing software that allows customers to instantly approve estimates, sign invoices, and pay their bill online– anytime, anywhere. Choose the best Billing Software for small business in Compare small business Billing Software using pricing, verified reviews, features, and more.

Best Insurance For Collectibles

Whether it's stamps, coins, wine, sports memorabilia, silver or etc, Chubb can help protect collections big and small. Explore our valuable articles. Homeowners insurance is a great option for protecting your home and your belongings. But it's not always the best option for protecting your collectibles. One of those companies is the largest homeowners/renters insurance company in the US, State Farm, which limits coverage on collectibles to $ Insurance companies group artwork, collectibles, and antiques together into one category and will typically only provide approximately $2, in coverage or. Sports Collectibles Insurance · Coverage up to $1 million (higher limits available) · Items insured for full collectible value · No appraisal required at. As a world leader in insurance, Chubb brings unmatched expertise and financial strength to provide comprehensive coverage for your precious collections. MiniCo Collectibles Insurance covers hundreds of collections, from fine art to sports memorabilia. In partnership with an A-rated carrier, we ensure collections. For over forty years, American Collectors Insurance has been providing the best coverage for collectors. From vintage G.I. Joe and Barbie Dolls to Lionel. We offer flexible, worldwide coverage options to meet your unique needs and cover most collectible losses with no deductible. Whether it's stamps, coins, wine, sports memorabilia, silver or etc, Chubb can help protect collections big and small. Explore our valuable articles. Homeowners insurance is a great option for protecting your home and your belongings. But it's not always the best option for protecting your collectibles. One of those companies is the largest homeowners/renters insurance company in the US, State Farm, which limits coverage on collectibles to $ Insurance companies group artwork, collectibles, and antiques together into one category and will typically only provide approximately $2, in coverage or. Sports Collectibles Insurance · Coverage up to $1 million (higher limits available) · Items insured for full collectible value · No appraisal required at. As a world leader in insurance, Chubb brings unmatched expertise and financial strength to provide comprehensive coverage for your precious collections. MiniCo Collectibles Insurance covers hundreds of collections, from fine art to sports memorabilia. In partnership with an A-rated carrier, we ensure collections. For over forty years, American Collectors Insurance has been providing the best coverage for collectors. From vintage G.I. Joe and Barbie Dolls to Lionel. We offer flexible, worldwide coverage options to meet your unique needs and cover most collectible losses with no deductible.

Protect your collectible items with a collectibles insurance from HWI. We offer The Hugh Wood United States team works with some of the best insurance. Proven and Trusted – Protecting collections since , all coverage is provided by a carrier with a group rating of “A” (Excellent) by A. M. Best, the leading. 1. American Collectors Insurance;. 2. Collectibles Insurance Services, LLC. Rare & collectibles insurance is a specialized type of insurance coverage designed to protect valuable items considered rare or collectible. CIS offers the best collectibles insurance service for whatever you consider valuable- vintage guns, sports cards, comic books, and more! Protect your collectibles and valuables with customized personal property insurance from Towne Insurance. Get a quote today. Also referred to as a personal articles floater or collectibles insurance, collections insurance protects your valuable collection from things like accidental. Homeowners insurance usually either does not cover collectibles or imposes a low limit on the coverage. · If you have valuable collections, it is generally wise. CIS' comic book and memorabilia collection insurance is the most comprehensive way to protect your rare, unique, or novel collections. Best Digital Insurance All Life Insurance Health Insurance Home Insurance Pet Insurance Business Insurance Disability Insurance Liability Insurance Car. Collectinsure is the answer. DO NOT use your homeowners policy thru State Farm (or whomever you have). Use a company that deals in collectibles. Berkley is a leader in collectibles insurance, providing thought leadership on how collectors can protect and care for their collections. Best Digital Insurance All Life Insurance Health Insurance Home Insurance Pet Insurance Business Insurance Disability Insurance Liability Insurance Car. After you have completed the inventory of your collection and have had it properly appraised, it's a good idea to insure it. Most homeowners insurance and. JGS Insurance assesses your collection and then works with several of the top insurance companies specializing in collectibles coverage to come up with the best. Insurance for collectibles and art is normally affordable. For example, a $10, piece will cost about $$/year to insure. If you want an exact price. At the Antiques & Collectibles Insurance Group, we make the process of finding the best insurance simple again. Because our agency is % independent, we have. Convinced yet? Zinc Collectibles offers the best coverage in worst-case scenarios. Let us assess your collection, help you determine the value, and provide you. To guarantee your collectibles and collections are covered in the event of an accident, you'll want to purchase scheduled personal coverage—also known as. To guarantee your collectibles and collections are covered in the event of an accident, you'll want to purchase scheduled personal coverage—also known as.

Concerta Making Me Tired

Concerta, Delmosart, Equasym, Medikinet Some people might get side effects like feeling dizzy, blurred vision, difficulty focusing or feeling sleepy when. Or if these have got worse while taking Concerta XL. Long-term feeling unusually sleepy or drowsy, feeling tired. • excessive teeth grinding. Methylphenidate may cause dizziness, drowsiness, or changes in vision. Do not drive or do anything else that could be dangerous until you know how this medicine. Concerta Withdrawal – Side Effects · Feeling irritable. You may feel in a bad mood and snap or argue with loved ones more than usual. · Panicking. Panic attacks. Understanding how Concerta affects the brain, it's easy to understand why weight loss and trouble falling asleep are among the milder side-effects of the drugs. me. It was then that I was diagnosed with fibromyalgia. I was prescribed Adderall and Vyvanse for my ADHD but they made me extremely tired. Currently, I am. Often you may feel awake right after you take it, but then you get very tired. Using Ritalin in ways it is not meant to be used can cause: headache or feeling. A person addicted to Concerta will experience uncomfortable withdrawal symptoms if they stop taking the drug, such as paranoia, fatigue, and depression. Often you may feel awake right after you take it, but then you get very tired. Using Ritalin in ways it is not meant to be used can cause: headache or feeling. Concerta, Delmosart, Equasym, Medikinet Some people might get side effects like feeling dizzy, blurred vision, difficulty focusing or feeling sleepy when. Or if these have got worse while taking Concerta XL. Long-term feeling unusually sleepy or drowsy, feeling tired. • excessive teeth grinding. Methylphenidate may cause dizziness, drowsiness, or changes in vision. Do not drive or do anything else that could be dangerous until you know how this medicine. Concerta Withdrawal – Side Effects · Feeling irritable. You may feel in a bad mood and snap or argue with loved ones more than usual. · Panicking. Panic attacks. Understanding how Concerta affects the brain, it's easy to understand why weight loss and trouble falling asleep are among the milder side-effects of the drugs. me. It was then that I was diagnosed with fibromyalgia. I was prescribed Adderall and Vyvanse for my ADHD but they made me extremely tired. Currently, I am. Often you may feel awake right after you take it, but then you get very tired. Using Ritalin in ways it is not meant to be used can cause: headache or feeling. A person addicted to Concerta will experience uncomfortable withdrawal symptoms if they stop taking the drug, such as paranoia, fatigue, and depression. Often you may feel awake right after you take it, but then you get very tired. Using Ritalin in ways it is not meant to be used can cause: headache or feeling.

These drugs include methylphenidate (Ritalin, Concerta). For people who feel fatigue, but are usually not as emotionally sensitive as those requiring. Well it was making me very, very tired. So now he's trying me on the lowest dose of Concerta. I was still feeling a bit drowsy and muddled so took two pills. When treatment was started at a younger age, it might be appropriate to continue taking Concerta XL when you become an adult. • feeling unusually sleepy or. Common side effects of the ADHD drug Concerta include appetite changes, trouble sleeping and an elevated heart rate. More serious reactions may also occur. Stopping Concerta suddenly can result in withdrawal. Symptoms of withdrawal include trouble sleeping and fatigue. Withdrawal increases your risk of developing. feeling very tired or weak. excessive thirst. feeling sleepy. loss of bladder control. Tell your doctor immediately if you notice any of the following. I am recently diagnosed adhd and started at 18mg.. about an hour in I feel sedated and want to sleep all day.. the fatigue never goes away.. is this a normal. Common Side Effects · Nausea (26%) · Dry mouth (20%) · Low appetite (16%) · Trouble sleeping (15%) · Feeling tired (10%) · Constipation (8%) · Dizziness (8%). decreased sex drive or difficulty getting and keeping an erection; feeling very tired or weak; excessive thirst; feeling sleepy; loss of bladder control. Tell. Taking a high dosage of Adderall and suddenly removing it from your routine can cause sleepiness and fatigue. If you have not told your doctor or pharmacist about any of the above, tell them before you/your child start taking CONCERTA. • feeling very tired or weak. me. It was then that I was diagnosed with fibromyalgia. I was prescribed Adderall and Vyvanse for my ADHD but they made me extremely tired. Currently, I am. These medications can also help reduce the feeling of fatigue while exercising. Muscle fatigue is caused by the buildup of lactate in the blood. Fatigue. Why is Concerta making me so tired?? I am recently diagnosed adhd and started at 18mg.. about an hour in I feel sedated and want to sleep all day.. the. Well it was making me very, very tired. So now he's trying me on the lowest dose of Concerta. I was still feeling a bit drowsy and muddled so took two pills. Significant increases in blood pressure or heart rate, shortness of breath, fatigue · Severe anxiety, panic attacks, mania, hallucinations, paranoia or delusions. The mallinckrodt brand is making me extremely tired in the afternoon and through meetings, which is vety unusual for me since I have been taking Concerta/ER. Or if these have got worse while taking Concerta XL. Long-term feeling unusually sleepy or drowsy, feeling tired. • excessive teeth grinding. One reason you start to feel sleepy is because your brain has been awake and working all day like it should be. And you naturally start to wind down at the end.

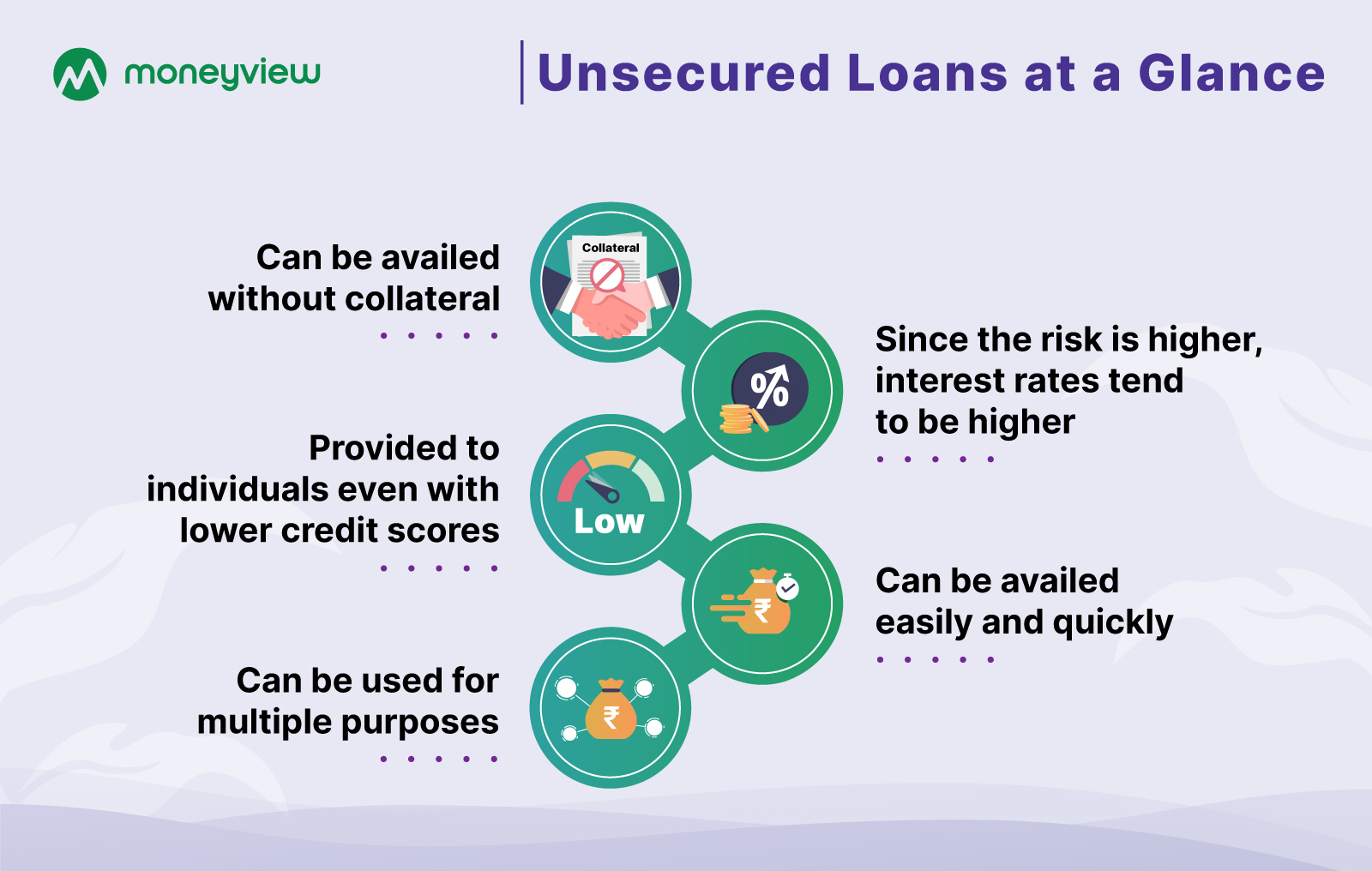

Whats An Unsecured Loan

and unsecured loans in order to make informed borrowing decisions. ▫ Identify items that could be purchased using a secured loan versus an unsecured loan. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. What is an Unsecured Personal Loan? A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. Banks may offer customers a variety of small-dollar, unsecured credit products and services that are related to their deposit accounts. A secured loan requires the borrower to pledge some sort of asset — such as a car, property or cash — as collateral; an unsecured loan does not require. An Unsecured Loan is a loan that does not require you to provide any collateral to avail them. It is issued to you by the lender on your creditworthiness as a. An unsecured loan is a loan not backed by collateral like a car or house. Lenders use your credit history to decide whether you qualify for an unsecured loan. Unsecured loans are great for unplanned expenses and often provide lower interest rate options than a credit card, with no collateral required. In an unsecured loan, a lender provides money to a borrower without any legal claim to the borrower's assets in case of default. This means the lender has. and unsecured loans in order to make informed borrowing decisions. ▫ Identify items that could be purchased using a secured loan versus an unsecured loan. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. What is an Unsecured Personal Loan? A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. Banks may offer customers a variety of small-dollar, unsecured credit products and services that are related to their deposit accounts. A secured loan requires the borrower to pledge some sort of asset — such as a car, property or cash — as collateral; an unsecured loan does not require. An Unsecured Loan is a loan that does not require you to provide any collateral to avail them. It is issued to you by the lender on your creditworthiness as a. An unsecured loan is a loan not backed by collateral like a car or house. Lenders use your credit history to decide whether you qualify for an unsecured loan. Unsecured loans are great for unplanned expenses and often provide lower interest rate options than a credit card, with no collateral required. In an unsecured loan, a lender provides money to a borrower without any legal claim to the borrower's assets in case of default. This means the lender has.

Unsecured loans allow you to borrow money without having to risk major assets such as your home. Learn more about this borrowing option. Learn the differences between secured debt and unsecured debt. Secured debt is guaranteed by its collateral while unsecured debt results from credit. How a secured personal loan works. A secured loan is a type of loan in which a borrower puts up a personal asset as collateral, such as a house or a car, or. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. An unsecured loan has no collateral behind it. Some common unsecured loans include student, personal and credit card loans. Lenders have more risk with these. How a secured personal loan works. A secured loan is a type of loan in which a borrower puts up a personal asset as collateral, such as a house or a car, or. A personal loan is a type of installment loan with a fixed rate and monthly payment. You receive a lump sum after approval and can use your loan for nearly any. Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow. Any type of loan that is specifically used for the purchase of an item that can be repossessed is a secured loan. For example, mortgages are secured loans. Secured and unsecured loans benefit borrowers differently based on their financial situation and the purpose of their loans. The best personal loan for you is the loan that meets all your needs and credit requirements, yet doesn't burden you with extra fees, penalties or unpleasant. Secured and unsecured borrowing explained. A secured loan usually means the lender can take your home if you fail to repay. Unsecured personal loans are less. An unsecured personal loan is a loan given out without the involvement of any collateral. It is based solely on the trust that the borrower will pay back the. An unsecured loan is a loan based on your creditworthiness and good faith promise to repay rather than collateral, such as a car or savings account. An unsecured personal loan isn't secured against your property and you can use it for just about anything without having to dip into or deplete your savings. Unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the. You'll have a scheduled repayment term, a monthly payment and no pre-payment penalty. It's ideal for financing any personal need, other than homes or vehicles. To be eligible for our unsecured loans or lines of credit, you must have a Regions deposit relationship (checking, savings, MM or CD) on which you are an owner. An unsecured personal loan is a loan that doesn't require you to put up any form of collateral—like a car, personal savings, or house. Unsecured loans often. It is security in case debt is not paid back. If the borrower cannot repay the loan, or misses payments, the lender may seize and sell the collateral.

Can You Refinance More Than You Owe

A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything. Refinancing Your Upside Down Auto Loan If you have been suckered into a car loan in which you owe more money to the lender than the car you bought with the. A cash out refinance replaces your current mortgage for more than you currently owe, and you get the difference in cash to use as you need. You can use the. Since you're borrowing more money than you currently owe on your existing car loan, you will have more debt to pay off after refinancing. Repossession. If your. Key takeaways about cash-out refinances → You're borrowing more than you currently owe. → You'll need more than 20% home equity to qualify. → There are. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. You may struggle to refinance your mortgage loan because lenders can't lend more money than a property is worth. In our earlier example, you could only. More debt. Taking cash out over and above the amount you owe on your vehicle means you'll be taking on more debt. Before you go through with a cash. You can refinance the amount that is owed, or up to the maximum loan amount. However, the first mortgage has to be paid off. A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything. Refinancing Your Upside Down Auto Loan If you have been suckered into a car loan in which you owe more money to the lender than the car you bought with the. A cash out refinance replaces your current mortgage for more than you currently owe, and you get the difference in cash to use as you need. You can use the. Since you're borrowing more money than you currently owe on your existing car loan, you will have more debt to pay off after refinancing. Repossession. If your. Key takeaways about cash-out refinances → You're borrowing more than you currently owe. → You'll need more than 20% home equity to qualify. → There are. With a cash out refinance, you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, if. You may struggle to refinance your mortgage loan because lenders can't lend more money than a property is worth. In our earlier example, you could only. More debt. Taking cash out over and above the amount you owe on your vehicle means you'll be taking on more debt. Before you go through with a cash. You can refinance the amount that is owed, or up to the maximum loan amount. However, the first mortgage has to be paid off.

In simple terms, a cash-out refinance is a lending option available when your home is worth more than what you owe on your mortgage. A cash-out refinance is a type of mortgage refinance that allows you to take out a loan for more than you owe on your current mortgage. The good news is that auto refinancing with cash out is simpler than you might think. Refinancing with cash out is simply using the equity you have in your. If your car is worth less than you still owe on your loan. If you have negative equity, most of the time it's not a good idea to refinance. · If the costs. Other types of debt can carry higher interest rates than mortgages. Paying off high-interest credit card debt, car loan or student loans is one way to use a. Refinancing your mortgage can allow you to change the term of your current mortgage to pay it off faster or lower your monthly payment. Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long. Refinancing means you owe the amount you refinance, thats not paying off anything. You could sell that house, move to a cheaper location with. With a cash-out refinance, your rate and term can still change, but the goal is to borrow more than you currently owe on your home and use the excess cash for. A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything. This is a great option if you have high-interest loans and you're only paying the interest rather than the principal. When you refinance, you can get up to a. In order to get a lower monthly payment, you'd need either a longer term or a lower APR. Refinancing isn't always worth it. A lot of these. Ex. If your home is worth $, and you owe $,, then you have $, in equity built up in your home. Be aware that normally you will not. With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. Step 4 Cash out your equity. A cash-out refinance allows you to borrow more money than you owe on the home, and then you can keep the difference as cash. You. In other words, with a cash-out refinance, you borrow more than you owe on your mortgage and pocket the difference. Do I Have to Pay Taxes on a Cash-out. Let's say your home is worth $,, and you still owe $, If your debt is $50, and you've got $, in equity, you could refinance that $, Doing so can dramatically decrease your monthly payments, making them more manageable. Paying off your car loan sooner. On the other hand, if you have more. A cash-out refinance loan — also known as a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in cash. You can access a cash-out refinance with a score of or higher (or for FHA loans), but a is preferred. Be mindful that your credit score directly.

Placing An Options Trade

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Options trading at Fidelity lets you pursue market opportunities intelligently. Apply to trade options. A put is the inverse of a call. Puts give you the right to sell shares of the underlying security at a set price over a set period of time. Search the stock or ETF you'd like to trade options on using the search bar (magnifying glass); Select the name of the stock or ETF; Select Trade on the. When trading stock options, there is no ownership of the underlying company and there is no opportunity to receive dividends. Options offer the advantage of. 1. Determine your objective. · 2. Search for options trade ideas. · 3. Analyze ideas. · 4. Place your options trade. · 5. Manage your position. In contrast a put option gives you the option to SELL a stock at the strike price on or before the expiration date. Put options are a bearish. To begin, look up the name of the underlying security you'd like to trade, then click the Strategy drop down menu and select options call. Once you have. By using put options to help protect the underlying asset against losses past the breakeven point in your investment portfolio, you can potentially shield. A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Options trading at Fidelity lets you pursue market opportunities intelligently. Apply to trade options. A put is the inverse of a call. Puts give you the right to sell shares of the underlying security at a set price over a set period of time. Search the stock or ETF you'd like to trade options on using the search bar (magnifying glass); Select the name of the stock or ETF; Select Trade on the. When trading stock options, there is no ownership of the underlying company and there is no opportunity to receive dividends. Options offer the advantage of. 1. Determine your objective. · 2. Search for options trade ideas. · 3. Analyze ideas. · 4. Place your options trade. · 5. Manage your position. In contrast a put option gives you the option to SELL a stock at the strike price on or before the expiration date. Put options are a bearish. To begin, look up the name of the underlying security you'd like to trade, then click the Strategy drop down menu and select options call. Once you have. By using put options to help protect the underlying asset against losses past the breakeven point in your investment portfolio, you can potentially shield. A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires.

To start trading in options through the mobile app, go to 'Quotations' and find the desired stock. Go to the security card. If an option is available for such. Initially, most investors should be approved for level one strategies, enabling them to create covered calls. And, if you have a salary, some trading history. 1. Assess Your Readiness · 2. Choose a Broker and Get Approved to Trade Options · 3. Create a Trading Plan · 4. Understand the Tax Implications · 5. Keep Learning. You can place options orders on the Trading Dashboard. Please note, options orders can only be placed from accounts that are approved for options trading. How to trade options in 5 steps · Step 1. Figure out how much risk you are willing to take · Step 2. Identify what you want to trade · Step 3. Pick a strategy. How to trade options in 5 steps · Step 1. Figure out how much risk you are willing to take · Step 2. Identify what you want to trade · Step 3. Pick a strategy. The put option is similar to the call option except that the owner has the right, but not the obligation, to sell a specific asset at a certain price and within. Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. The more the market value. With put options, the holder obtains the right to sell a stock, and the seller takes on the obligation to buy the stock. If the contract is assigned, the seller. The basics · Call buyer. Pays a premium for the right to purchase the underlying investment from the call seller at the strike price · Put buyer. Pays a premium. How to trade options · Step 3 - Test your strategy. Before placing your trade on the Power E*TRADE platform, visualize and test your trading strategy using the. You could exercise the option, buy shares at the stock price, immediately sell them at the higher stock price, and make a profit. Likewise, put options have. Watch this video to learn how to enter an options trade with Fidelity's easy-to-use trade ticket. Watch the video, here. All you need to do is navigate to the Wallet tab, click “Get eToro Options” and follow the required prompts. If it's your first time trading options, you'll. How much does it cost to trade options on Public? Unlike many other investing platforms, we don't charge commissions or per-contract fees when you place an. You must have enough money in your settlement fund to cover your purchase when you place an order. You can't place an order and fund it later. The trade will. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. What options strategies does RBC Direct Investing allow? You can purchase call options and put options, write covered calls and, with special exception, write. How to Place an Options Order. You can place options orders on the Trading Dashboard. Please note, options orders can only be placed from accounts that are. Whether you are an advanced trader, or a beginner looking for more guidance, we have options tools & resources to help. Get unlimited $0 online option.

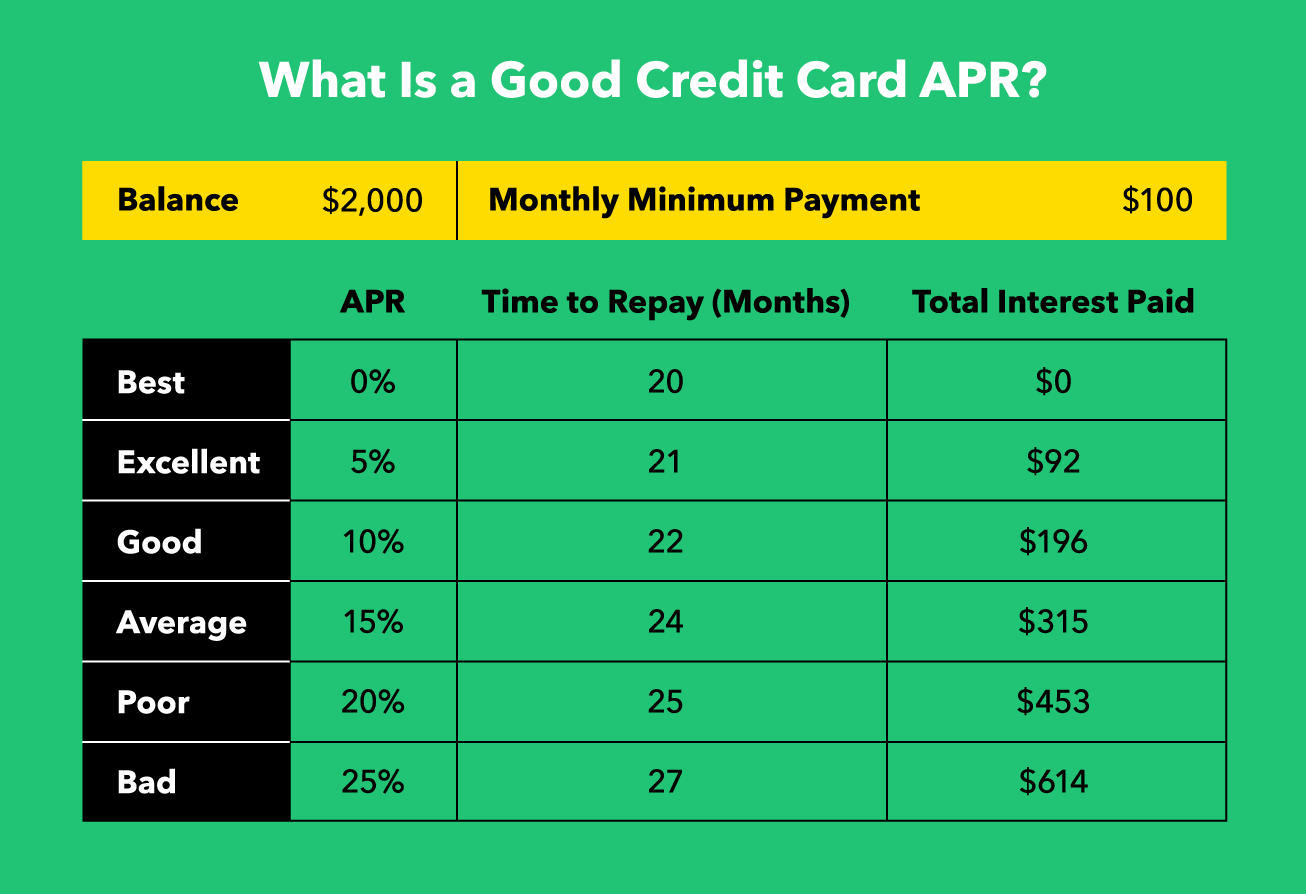

Is Low Or High Apr Better

If you can afford to pay your credit card balance on your high-interest credit card in full by its due date, you absolutely should to maintain a good credit. Low Interest Rates (%) APR1. No Application or Origination Fees The highest APR is based on the following assumptions: A PA Forward. A good APR is around 22%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%. low introductory APR, interest on the balance is quite high. Credit card APRs average about 20%, which is relatively high for any loan. Good APRs average. A lower interest rate means you pay less money. A higher interest rate means you pay more money. For example, a loan with a 2% interest rate costs less than a. This is because lenders see low-credit borrowers as risky or more likely to default on their loans than those with good credit. You usually want to choose a. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. This means that a. On the other end of the range, double-digit APRs are common for credit cards, but an APR over 30% is always bad. Outside those broad lines, whether a specific. Barclay's offers an 8% APR and you generally get %% APR with good credit. Anything over that obviously wouldn't be ideal and some. If you can afford to pay your credit card balance on your high-interest credit card in full by its due date, you absolutely should to maintain a good credit. Low Interest Rates (%) APR1. No Application or Origination Fees The highest APR is based on the following assumptions: A PA Forward. A good APR is around 22%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%. low introductory APR, interest on the balance is quite high. Credit card APRs average about 20%, which is relatively high for any loan. Good APRs average. A lower interest rate means you pay less money. A higher interest rate means you pay more money. For example, a loan with a 2% interest rate costs less than a. This is because lenders see low-credit borrowers as risky or more likely to default on their loans than those with good credit. You usually want to choose a. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. This means that a. On the other end of the range, double-digit APRs are common for credit cards, but an APR over 30% is always bad. Outside those broad lines, whether a specific. Barclay's offers an 8% APR and you generally get %% APR with good credit. Anything over that obviously wouldn't be ideal and some.

This means that maintaining a good credit score could result in lenders offering you lower This APR is usually higher than your purchase APR. APR may. It depends on what you call high apt to some people is high apr and other people consider as low. not know your situation this is. If you're using the credit card correctly, no annual fee is dramatically better than any interest. · You shouldn't be carrying a balance from. APR (Low to High). . Better · EXPLORE QUOTE. Better: NMLS# Lowest APR. Lowest monthly payment. Great for digital convenience. Conventional year fixed. A lower APR is usually better, as it costs you less to borrow using a particular credit card. For example, it may only apply if you pay your balance in full each month. A lower interest rate may be a better deal. For more information about APR, see. A lower interest rate will cost you less over the life of a loan and credit card purchases. Interest rates will inevitably be a large part of your financial. The lower your personal loan APR, the less money you'll pay in financing costs over the life of the loan. Read more about how to get a good personal loan rate. How can I lower my credit card APR? · 1. Improve your credit score. An improvement in your credit score is critical if you want to start reducing the APR you're. A lower interest rate credit card can help you save on the cost of debt by making it easier to pay down your balance faster. We're sorry, this page is. What Is a Good APR? What counts as a “good” APR will depend on factors such as the competing rates offered in the market, the prime interest rate set by the. It depends on what you call high apt to some people is high apr and other people consider as low. not know your situation this is. Credit score requirements. You will need a credit score of or better to qualify for one of the best low-APR cards, and a higher score will help you get. If you have really crummy credit, the average APR offered is %. That's a big difference. The good news is that the average FICO Score of Americans in. A lower interest rate typically translates to lower overall mortgage costs and monthly payment. Annual percentage rate. The APR is the cost to borrow money as a. A lower interest rate will cost you less over the life of a loan and credit card purchases. Interest rates will inevitably be a large part of your financial. Get matched with a personalized set of Card offers in as little as 30 seconds. You may be eligible to earn a higher welcome bonus, or we may match you with. Do you want to consolidate credit card debt? Bank of America® has credit cards that offer low intro APRs on qualifying balance transfers for those looking. Request a lower APR: You can try calling your card issuer and negotiating a lower interest rate. Keep in mind that before doing so you'll want to make sure. Low intro APR credit cards offer a competitive annual percentage rate on credit card purchases or balance transfers during a specified introductory period.

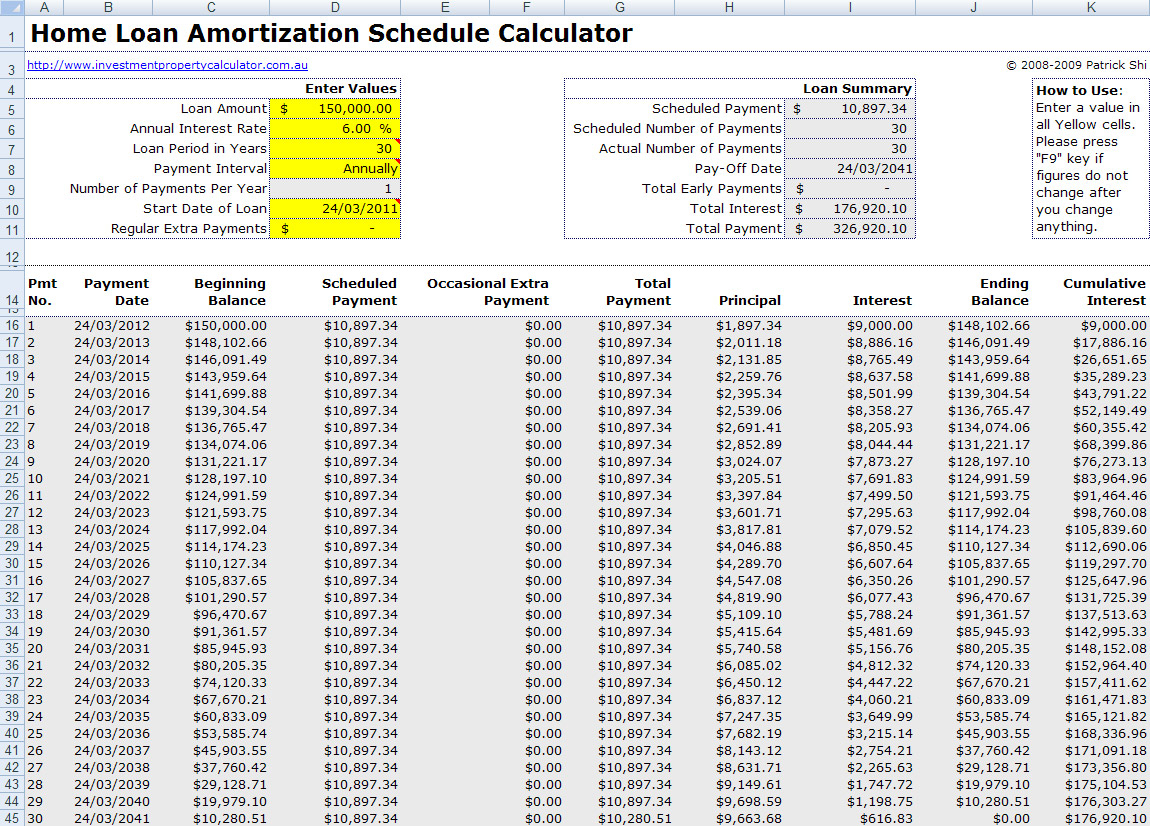

New Mortgage Loan Calculator

Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. New total monthly payment $1, (Principal, Interest, Taxes, Insurance and Results in no way indicate approval or financing of a mortgage loan. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. loan – good for new loans or preexisting loans that have never been supplemented with any external payments. Original loan amount. Original loan term, years. Use our mortgage payment calculator to see how much your monthly payment could be Welcome to the new Quicken Loans, the cutting-edge online marketplace. Use this calculator to figure out your monthly payment Housing costs. New home purchase price. Down payment. $50, Expected monthly rent. $1, Mortgage. Quickly see how much interest you could pay and your estimated principal balances. Enter prepayment amounts to calculate their impact on your mortgage. Use this mortgage payment calculator to get a better picture of what monthly payments to expect based on your house price, interest rate and down payment. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. New total monthly payment $1, (Principal, Interest, Taxes, Insurance and Results in no way indicate approval or financing of a mortgage loan. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. loan – good for new loans or preexisting loans that have never been supplemented with any external payments. Original loan amount. Original loan term, years. Use our mortgage payment calculator to see how much your monthly payment could be Welcome to the new Quicken Loans, the cutting-edge online marketplace. Use this calculator to figure out your monthly payment Housing costs. New home purchase price. Down payment. $50, Expected monthly rent. $1, Mortgage. Quickly see how much interest you could pay and your estimated principal balances. Enter prepayment amounts to calculate their impact on your mortgage. Use this mortgage payment calculator to get a better picture of what monthly payments to expect based on your house price, interest rate and down payment. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank.

Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. You can use our free house loan calculator to crunch the numbers and get an new account customers. This notice is being provided to you for. Rate Comparison Calculator. How Much Should I Put Down on a New Home? Down Payment Calculator. See All Mortgage Calculators. Mortgage Calculators. Next Steps. Mortgage Loan Type? Choose the mortgage term. A year fixed mortgage will have a higher monthly payment because you will be paying back more of the loan each. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use SmartAsset's free California mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Calculate your new construction loan or refinance options below. Input your details and hit Calculate to view your loan terms and an interactive graph. payment you put toward the cost of your new home. How much do you plan to put down? You could put little-to-no money down depending on your loan type. Chase Home Lending. We offer a variety of mortgages for buying a new home or refinancing your existing one. New to homebuying? Our Learning Center provides easy. Our easy-to-use calculators will help you generate a mortgage estimate. View personalized scenarios to see what home loan may work best for you. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Enter new figures to override. Home Purchase Price. $. Down Payment Results in no way indicate approval or financing of a mortgage loan. Contact. A mortgage payment calculator helps you determine how much you Mortgage refinance is the process of replacing your current mortgage with a new loan. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. What is a mortgage calculator? It's a tool to help you better understand your home financing options, whether you're purchasing a new home or refinancing your. Explore more mortgage calculators. Mortgage calculator. What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use. Use our mortgage payment calculator to estimate your monthly mortgage payment year fixed mortgage (new purchase). Loan type. Rate. ( APR). Latest Mortgage Rate: 30 Years: % 15 Years: % 10 Years: %. See In other words, the purchase price of a house should equal the total amount of.

Best Websites To Get Paid To Take Surveys

8. Swagbucks stars · Take surveys, earn points. Daily survey and fun polls available for easy earning. · Redeem your points for dozens of options including. InboxDollars then rewards you with your choice of free cash, PayPal, or gift card. It's easy to get paid for sharing your opinions, and we're one of the best. QuickRewards stands out as one of the fastest-paying survey sites globally, with a minimum withdrawal threshold of just $ If you dislike sites with high. 17 Companies Offering Paid Online Surveys for money (Up to $/Week) · Avatar. Virginia Nakitari| Work From Home Jobs| Make Money Online| Side Hustle Ideas ; Top. This means that you can make some extra money simply by answering questions and offering your opinion. Some of the best paid survey sites include Offernation. I've put together this list of the best legitimate free paid survey sites. I included survey sites that pay through PayPal or offer free gift cards. Pinecone Research Canada is a name synonymous with top-quality paid surveys. This exclusive platform is known for its high-paying surveys and. These are some of the best survey sites and quick-cash games, selected based on their reputation and the amount of money you can realistically earn in a month. The below list of survey sites pay the most money: 1. Toluna 2. MyLead 3. Valued Opinion 4. iPanelOnline 5. Swagbucks 6. LifePoints 7. YouGov 8. Telly Pulse. 8. Swagbucks stars · Take surveys, earn points. Daily survey and fun polls available for easy earning. · Redeem your points for dozens of options including. InboxDollars then rewards you with your choice of free cash, PayPal, or gift card. It's easy to get paid for sharing your opinions, and we're one of the best. QuickRewards stands out as one of the fastest-paying survey sites globally, with a minimum withdrawal threshold of just $ If you dislike sites with high. 17 Companies Offering Paid Online Surveys for money (Up to $/Week) · Avatar. Virginia Nakitari| Work From Home Jobs| Make Money Online| Side Hustle Ideas ; Top. This means that you can make some extra money simply by answering questions and offering your opinion. Some of the best paid survey sites include Offernation. I've put together this list of the best legitimate free paid survey sites. I included survey sites that pay through PayPal or offer free gift cards. Pinecone Research Canada is a name synonymous with top-quality paid surveys. This exclusive platform is known for its high-paying surveys and. These are some of the best survey sites and quick-cash games, selected based on their reputation and the amount of money you can realistically earn in a month. The below list of survey sites pay the most money: 1. Toluna 2. MyLead 3. Valued Opinion 4. iPanelOnline 5. Swagbucks 6. LifePoints 7. YouGov 8. Telly Pulse.

Online paid surveys are a legitimate business, as many different companies utilize them to conduct market research. Some of the best paid online survey sites include boxblog.ru, Swagbucks, Survey Junkie, boxblog.ru, boxblog.ru and Qmee. All of these are trusted. 10 Legit Paid Survey Sites · 1. Swagbucks Paid Survey. Swagbucks is one of the most popular reward sites where you can earn points known as SB (Swagbucks). · 2. This means that you can make some extra money simply by answering questions and offering your opinion. Some of the best paid survey sites include Offernation. Millions of people trust Survey Junkie and share their opinions and behaviors in exchange for rewards and gift cards. Take surveys and make money online. Swagbucks: Take Paid Surveys, Get Cash and Free Gift Cards*, Find Money Making Deals Swagbucks is a free reward app where you get paid for your opinion. Join to get free points ($) - cash out your earnings with just $5 in your account. Earn points for taking surveys, participating in daily polls and. I recommend signing up for at least the first 3 survey sites, Surveyjunkie, Swagbucks & Respondent first to see if this is a side hustle you are interested in. In this detailed article, I'll tell you exactly how paid surveys work, how you can get paid to take surveys online, the best survey companies you should sign. Our testing shows you can earn $10 to $40 monthly by completing a few surveys daily from the right mix of sites and apps. Being able to influence the creation of products and services can be exciting, and this survey panel lets you do just that. Survey Junkie is a website that you. American Consumer Opinion is a free online survey company I highly recommend. They pay you for each survey you complete. You can usually earn anywhere from $1. #1 - Freecash Short summary: Freecash is one of the newer GPT sites and it has several ways to earn. But the best way to earn here is by taking paid surveys. app, Toluna, Branded Surveys, Swagbucks, Survey Junkie, OnePoll, i-Say, etc. It's important to mention that the payout of online surveys is affected by factors. Ratings and Reviews · Eureka is one of THE best survey apps in my opinion. In under 30 days I've earned nearly bucks from just taking surveys. · Hi, Thanks. Top 10 Paid Survey Sites to Earn Extra Cash & Gift Cards · Swagbucks · Branded Surveys · InboxDollars · Survey Junkie · Freecash · Ipsos iSay · Opinion Outpost. The best survey sites are going to be honest and upfront with your potential earnings, offer additional ways to make money, and will be easy to use. Greenfield online, and survey spot are a couple good ones. But most you will not qualify for. I agree with hpgood boy. Try your hand at affiliate marketing. These are some of the best survey sites and quick-cash games, selected based on their reputation and the amount of money you can realistically earn in a month. You can participate any time you want! Taking surveys is a great side hustle because it can be done at any time of the day or night. You can work on the surveys.