boxblog.ru

News

Can You Repair A Clutch

We provide complete clutch replacement from start to finish and can usually complete the job in one day. Includes transmission removal, flywheel resurfacing. Our technicians can diagnose and repair all types of clutch problems, including worn-out clutch plates, faulty pressure plates, and hydraulic system issues. We. Clutch systems are usually parts that stand the test of time very well, so it is not very common to repair them. However, if our car is used to driving many. Find the problem If the clutch feels stiff, you should first inspect the entire clutch cable. Start where it is connected to the clutch pedal under the dash. A clutch replacement can be quite expensive and is also one of the more complicated and lengthy repairs on a vehicle with manual transmission. To avoid having. Since the clutch is one of the most used parts in a car, even careful usage of the clutch pedal cannot save your clutch over time. It will become worn down and. As long as the failed bearings didn't damage the pulley shaft, you still have the option to either rebuild or replace the fan clutch. CATASTROPHIC FAILURE –. The clutch is a crucial component that your transmission needs to function properly. If your clutch has burned out or otherwise stopped functioning, you'll need. Clutch repair costs tend to be expensive, but understanding the reasons behind the high prices can help you avoid unexpected bills. We provide complete clutch replacement from start to finish and can usually complete the job in one day. Includes transmission removal, flywheel resurfacing. Our technicians can diagnose and repair all types of clutch problems, including worn-out clutch plates, faulty pressure plates, and hydraulic system issues. We. Clutch systems are usually parts that stand the test of time very well, so it is not very common to repair them. However, if our car is used to driving many. Find the problem If the clutch feels stiff, you should first inspect the entire clutch cable. Start where it is connected to the clutch pedal under the dash. A clutch replacement can be quite expensive and is also one of the more complicated and lengthy repairs on a vehicle with manual transmission. To avoid having. Since the clutch is one of the most used parts in a car, even careful usage of the clutch pedal cannot save your clutch over time. It will become worn down and. As long as the failed bearings didn't damage the pulley shaft, you still have the option to either rebuild or replace the fan clutch. CATASTROPHIC FAILURE –. The clutch is a crucial component that your transmission needs to function properly. If your clutch has burned out or otherwise stopped functioning, you'll need. Clutch repair costs tend to be expensive, but understanding the reasons behind the high prices can help you avoid unexpected bills.

The time it takes to replace a clutch can vary depending on the type of vehicle you have, but it's generally between two and six hours. For many, this means you. Therefore, it is important that you treat your clutch with respect. On average, a clutch should last between 60, to 80, miles (about 96, to , You have no items in your shopping cart. Search. Home /; Transmissions - Manual /; South Bend Clutch Repair Kits. Shop by truck. Filter products. Filter by. These parts should ALL be replaced, even if they don't appear worn. The pilot bearing or bushing, which sits at the end of the transmission shaft should also be. Signs That You May Need A Clutch Repair Service · Slipping Clutch · Dragging Clutch · Soft or Spongy Pedal · Hard Clutch · Strange Noises. Unusual grinding. Can I replace the clutch myself? No, clutch replacement is a job for an experienced technician. Transmission removal is required, and special tools are often. Rev up your ride with Pep Boys' clutch replacement service. Our technicians will have you shifting gears smoothly in no time. Schedule today! If you are experiencing issues with your clutch, it is best to bring your car to a technician who can run a diagnostic test and efficiently make the appropriate. The mechanic will have to check if the flywheel needs cleaning, a few minor repairs, or even a replacement to avoid damaging your new clutch. Afterwards, the. A jammed self-adjusting mechanism in a clutch can lead to improper functioning. You can either replace or repair the clutch. Oil Contamination. Your driving habits can influence how quickly your clutch will need fixing. When the time comes, you'll need a qualified transmission expert who can provide. What We Do Grease Monkey technicians inspect, repair, and replace clutch components, including full clutch replacement. Select Grease Monkey Full Service. You will need a jack, a screwdriver, lubricant, and a new clutch and flywheel. This step-by-step guide to help you replace your car clutch if you do not have. Notchy gear changes and engine rev's rising without an increase in speed are a sure sign of a worn and slipping clutch. A clutch replacement can be completed at. Clutches experience a lot of strain, typically wearing out at some point after 60, miles. As you might already know, replacing a clutch can be expensive. As a mobile mechanic we can work on your car and provide clutch repair services. A clutch is integral to getting your car moving and working properly. While. Do you require quality clutch repair service? If you are having problems with your clutch system, you should have it checked out by qualified experts. Did you. You should replace your clutch when it gets too worn to work properly. Most clutches will need to be replaced between 50, to , miles. However, you may. The average lifespan of a clutch is anywhere between 20, to , miles. Luckily, your clutch will likely give you ample notice that something is going.

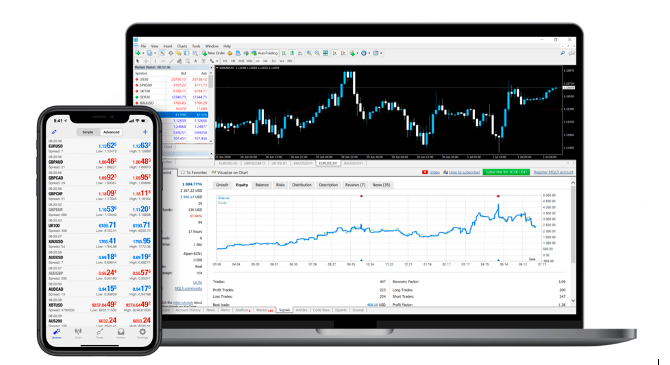

What Is The Best Day Trading Broker

There are various aspects to take into consideration when choosing a day trading account and online broker like us. An online broker like us facilitates the. 1. E*TRADE · 2. TD Ameritrade · 3. Ally Invest · 4. Merrill Edge · 5. TradeStation · 6. Webull · 7. Interactive Brokers. Overview: Top online brokers for day trading in September · Fidelity Investments · Interactive Brokers · TradeStation · E-trade Financial · Charles Schwab. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. boxblog.ru has carefully researched the top stock brokers, comparing everything from head to toe. Read our expert reviews to find the right broker for you. IBKR BestXTM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while. We based our selections on brokerages that were known for fast and reliable trade executions with benefits for day traders. The primary trading platforms that much of the Bullish Bears community uses are TradeStation, ThinkorSwim (ToS), CMEG, and Interactive Brokers. However, this. Popular brokers for day trading include Interactive Brokers, TD Ameritrade, E*TRADE, Charles Schwab, and TradeStation, among others. It's. There are various aspects to take into consideration when choosing a day trading account and online broker like us. An online broker like us facilitates the. 1. E*TRADE · 2. TD Ameritrade · 3. Ally Invest · 4. Merrill Edge · 5. TradeStation · 6. Webull · 7. Interactive Brokers. Overview: Top online brokers for day trading in September · Fidelity Investments · Interactive Brokers · TradeStation · E-trade Financial · Charles Schwab. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. boxblog.ru has carefully researched the top stock brokers, comparing everything from head to toe. Read our expert reviews to find the right broker for you. IBKR BestXTM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while. We based our selections on brokerages that were known for fast and reliable trade executions with benefits for day traders. The primary trading platforms that much of the Bullish Bears community uses are TradeStation, ThinkorSwim (ToS), CMEG, and Interactive Brokers. However, this. Popular brokers for day trading include Interactive Brokers, TD Ameritrade, E*TRADE, Charles Schwab, and TradeStation, among others. It's.

Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. We've compiled a list of the best day trading platforms in the UK. These are our top day trading apps for buying and selling UK and overseas stocks and shares. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open account. $0 per online stock and ETF. Note. Because the $25, portfolio value requirement is set by FINRA, all brokerages are required to. Lightspeed is known for its many trading platforms, day-trading services, and discounts for frequent traders. TRADE EQUITY FUTURES WITH $50 DAY TRADING MARGINS AND NO FUNDING MINIMUM We use cookies to ensure that we give you the best experience on our website. Find the best online broker for you. Read and compare online broker reviews, rankings, and features. 1. E*TRADE · 2. TD Ameritrade · 3. Ally Invest · 4. Merrill Edge · 5. TradeStation · 6. Webull · 7. Interactive Brokers. With our modern trading platform This interactive livestream reviews the day's trading, news, and events, helping you make the best informed decisions. Online brokers with no PDT rule? The best brokers to avoid being a pattern day trader are CMEG Group and eToro. In this article, we will explore the top 10 best brokers for day trading, outlining their key features, advantages, and potential drawbacks. We have ranked and reviewed the best day trading platforms for short-term speculation through CFDs, futures and options. Fidelity is our top pick for the lowest fees because the platform offers $0 commission on US stock trades, ranking among the most competitively priced platforms. We've compiled a list of the best day trading platforms available in the US, taking into consideration factors such as speed of execution, customizability. 1. Interactive Brokers: Best overall · 2. TradeStation: Best for Web and technology · 3. Robinhood: Best fees · 4. XM: The best platform for mobile trading · 5. Publicly listed stocks can only be traded through a licensed broker or brokerage. Brokers enable clients, who may be investors or traders, to participate in. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Best Brokers For Day Trading For A Living ; 1. NinjaTrader logo. NinjaTrader ; 2. eToro USA logo. eToro USA ; 3. Interactive Brokers logo. Interactive Brokers ; 4. Top 10 Brokers for Day Trading Ranked by Trustpilot Score ; 1. Fusion Markets, 1,, ⭐ ; 2. FP Markets, 6,, ⭐ ; 3. IC Markets, 37,, ⭐ ; 4. Jigsaw's day trading software and education helps traders learn faster, trade smarter with simple, repeatable methods based on professional order flow.

Risk Averse Investor

Speaking more practically, risk aversion is an important concept for investors. A risk averse investor prefers low risk investments that offer a guaranteed, or. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. A risk-averse investor will avoid taking on too much risk in their investment strategy. Risk-averse investment strategies will therefore veer towards. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Example: A risk-averse investor is someone who prefers to invest in low-risk options such as bonds or mutual funds rather than high-risk options like stocks or. Risk averse investing is a common approach for the short-term. Returns may be lower but they are less likely to be negative. The opposite is risk tolerance. In the short term, risk-averse investors are not making sudden changes to their portfolios. They are not making transactions during market fluctuations which. When the initial investment amount was lowered to $10 million, with a possible gain of $40 million, the managers were just as cautious: On average, they wouldn'. Speaking more practically, risk aversion is an important concept for investors. A risk averse investor prefers low risk investments that offer a guaranteed, or. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks. A risk-averse investor will avoid taking on too much risk in their investment strategy. Risk-averse investment strategies will therefore veer towards. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Example: A risk-averse investor is someone who prefers to invest in low-risk options such as bonds or mutual funds rather than high-risk options like stocks or. Risk averse investing is a common approach for the short-term. Returns may be lower but they are less likely to be negative. The opposite is risk tolerance. In the short term, risk-averse investors are not making sudden changes to their portfolios. They are not making transactions during market fluctuations which. When the initial investment amount was lowered to $10 million, with a possible gain of $40 million, the managers were just as cautious: On average, they wouldn'.

Investors who are less risk averse may allocate more of their equity investment to riskier stocks and funds, though they may pay a price in terms of less than. 1. Short-term bond fund The best alternative for investors who do not want exposure to FDs or volatile instruments. i. Risk-Averse. These are the investors that have to dislike the risk, so they basically like to make investments in the assets that have a sure return. Risk aversion is the behaviour exhibited by investors when they prefer outcomes with assured returns over outcomes which have higher, but uncertain returns. Key Takeaways. Risk-averse investors often focus on capital preservation and income generation and avoid taking on select low-risk investment options. The money market is home to short-term debt investments. It gives the investor an opportunity to invest in highly liquid vehicles like call deposits. How do we measure the risk aversion of an investor? Several qualitative psychological methods suggest that one should determine what is the most appropriate. If you're a risk-averse investor, the opposite is true. You would opt for investments that aim to 'defend' your investments against losses – even if it. Proof that Diversification Reduces Risk. Consider a two risky asset example. An investor invests the fraction 1− f of his wealth in a low-risk asset. In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty. A risk-averse investor will gravitate towards a guaranteed outcome and shy away from risky investments. A lower, certain return will be preferable to a higher. Prospect theory and the idea of investors being loss-averse rather than risk-averse go back to Daniel Kahneman and Amos Tversky (). Describes an investor who, when faced with two investments with the same expected return but different risks, prefers the one with the lower risk. Conservative investing is an example of a risk-averse investment strategy. Conservative investing is an investment strategy that focuses on lower-risk. The ideal way to kick start your investment journey is to start small, learn from your mistakes and then move forward accordingly to minimize your losses. If. Smart investors consider both risk and return. Investments with higher expected returns (and higher volatility), like stocks, tend to be riskier than a more. Risk aversion relates to the notion that investors as a rule would rather avoid risk. Given a choice of two investments with equal returns, risk-averse. Risk-averse investors do not like taking risks. They prefer lower returns instead of higher ones because the lower return investments are less risky. A risk-loving investor might be more willing to take chances on new and unproven companies (startups), while a risk-averse investor would prefer.

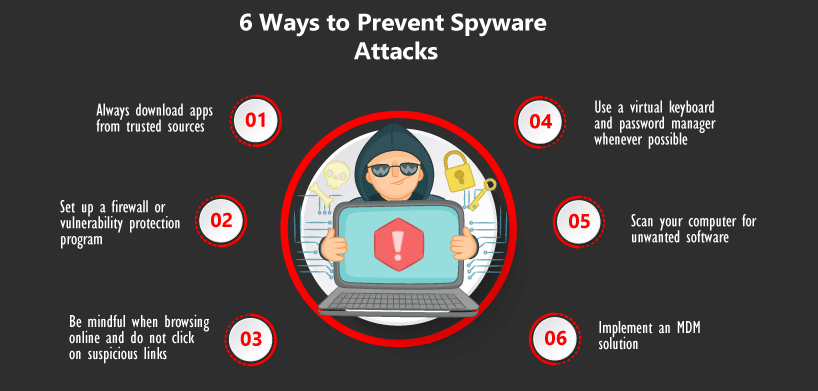

How Do You Stop Spyware

Unlike some other types of malware, spyware authors do not really target specific groups or people. Instead, most spyware attacks cast a wide net to collect as. This information sheet will help you identify whether that is likely, and what steps can be taken to help identify and potentially remedy the spyware. The best way to control spyware is by preventing it from getting on your computer in the first place. However, avoiding program downloads and email attachments. Step 1: Remove malware Windows computers Mac computers Chromebooks You can remove unwanted apps from your Chromebook. Install an anti-malware app: The first step is to install a reputable anti-malware app from a trusted source such as the Google Play Store or. Here's the step-by-step process on how to stop someone spying using mSpy on an iPhone using iMyFone AnyTo. Restart in Safe Mode. Scan your computer (this could take a while). Remove any spyware that is found. Reboot your computer and scan again. How to remove malware such as a virus, spyware, or rogue security software · 1. Install the latest updates from Microsoft Update · 2. Use the free Microsoft. Step 1: Disconnect your computer from the Internet. Step 2: Go to safe mode and disable the programs from startup. Step 3: Download antivirus software and run. Unlike some other types of malware, spyware authors do not really target specific groups or people. Instead, most spyware attacks cast a wide net to collect as. This information sheet will help you identify whether that is likely, and what steps can be taken to help identify and potentially remedy the spyware. The best way to control spyware is by preventing it from getting on your computer in the first place. However, avoiding program downloads and email attachments. Step 1: Remove malware Windows computers Mac computers Chromebooks You can remove unwanted apps from your Chromebook. Install an anti-malware app: The first step is to install a reputable anti-malware app from a trusted source such as the Google Play Store or. Here's the step-by-step process on how to stop someone spying using mSpy on an iPhone using iMyFone AnyTo. Restart in Safe Mode. Scan your computer (this could take a while). Remove any spyware that is found. Reboot your computer and scan again. How to remove malware such as a virus, spyware, or rogue security software · 1. Install the latest updates from Microsoft Update · 2. Use the free Microsoft. Step 1: Disconnect your computer from the Internet. Step 2: Go to safe mode and disable the programs from startup. Step 3: Download antivirus software and run.

Try Clario to scan your phone for spy apps and remove any unwanted spyware in just a few clicks. Just follow these steps to start safeguarding your Android. Spyware is a type of malware that logs information about the user of a computing device and shares it with third parties. Antivirus protection scans your files and your incoming email for viruses, and then deletes anything malicious. You must keep your antivirus software updated to. Programs are available to remove or block spyware. Some anti-virus programs also protect against spyware. If you have an anti-virus program installed, check to. HitmanPro- will remove all malware in Kaspersky's, Bitdefender's, and Sophos' signature database. ESET Online Scanner- will also remove malware. Step 1: Disconnect your computer from the Internet. Step 2: Go to safe mode and disable the programs from startup. Step 3: Download antivirus software and run. SUPERAntiSpyware protects you from malware, ransomware & spyware. Start your free trial today & remove Spyware, Rootkits, Adware, Viruses & More! Remove malware or unsafe software · Step 1: Make sure Google Play Protect is turned on · Step 2: Check for Android device & security updates · Step 3: Remove. You can remove Spyware from Android using boxblog.ru - Data Eraser (Android). It ultimately wipes out the spyware and all data from your Android device. After that. remove or block spyware. Programs such as PC Tools' Spyware ended up settling, by agreeing to pay US$ million and to stop distributing spyware. Antivirus software not only scans and removes spyware but can also block spyware from getting onto your Android phone in the first place. Remove spyware and viruses from your Windows™ PC or Mac®, Android™ or iOS device with Norton™ Spyware & Virus Removal service. Fast and easy remote service. Step 1 – Install Anti Spyware Software. Download and install the Malwarebytes' free anti spyware protection software. Click the “Scan” button and the spyware. Sophos Home Premium protects your home computers from advanced malicious threats with the best malware protection available on the market. The four common types of spyware are adware, Trojans, internet tracking, and system monitors. Their function ranges from tracking your browser activity so. In this article, we'll discuss how to stop someone from spying on your phone and how to secure your phone from spy software. Spyware Definition. Spyware is malicious software that enters a user's computer, gathers data from the device and user, and sends it to third parties without. By Antivirus Software · Click Start. · Scroll down and select Settings. · Go to Update & Security. · Select Windows Security. · Open Virus & Threat Protection. How Do You Prevent Spyware From Infecting Your Computer? · Think Before You Click · Have Cybersecurity Awareness · Keep Operating System Up-To-Date · Download. Malware includes viruses, spyware, ransomware, and other unwanted software that gets secretly installed onto your device.

First Hour Of Trading

Many traders only trade the first hour and the last hour of every day, as these times are the most volatile. pmpm: The market closes at 4pm. After. Pre-market trading happens before the market opens. While hours may vary between brokerage firms, they can extend as early as 4 am and run until the opening. It seems to me, the first hour, especially the first mins of market open is the easiest to follow the trend to scalp. In simple words, Initial Balance (IB) is the price data, which are formed during the first hour of a trading session. Activity of traders forms the so-called. The impact varies across markets. For stocks (S&P ), the first trading hour is most volatile. In the Swiss Franc, the first midday session stands out. Gold. Many professional traders trade actively in the first hour or two of trading and take the middle of the day off. This is the best time of Aug 2. The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. Many traders consider the time frame between am to am the ideal time to make trades. This is because in the first few hours of the market opening. Pre-market trading generally happens from 8 am to am ET, though it can start earlier. After-hours trading starts at 4 pm and can run as late as 8 pm ET. Many traders only trade the first hour and the last hour of every day, as these times are the most volatile. pmpm: The market closes at 4pm. After. Pre-market trading happens before the market opens. While hours may vary between brokerage firms, they can extend as early as 4 am and run until the opening. It seems to me, the first hour, especially the first mins of market open is the easiest to follow the trend to scalp. In simple words, Initial Balance (IB) is the price data, which are formed during the first hour of a trading session. Activity of traders forms the so-called. The impact varies across markets. For stocks (S&P ), the first trading hour is most volatile. In the Swiss Franc, the first midday session stands out. Gold. Many professional traders trade actively in the first hour or two of trading and take the middle of the day off. This is the best time of Aug 2. The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. Many traders consider the time frame between am to am the ideal time to make trades. This is because in the first few hours of the market opening. Pre-market trading generally happens from 8 am to am ET, though it can start earlier. After-hours trading starts at 4 pm and can run as late as 8 pm ET.

How has IVR behaved in the first hour of trading? Over the last 30 days, IVR stock price had an average +% return in the first hour of trading. 52% of those. Market volume and prices can and do go wild first thing in the morning, precisely the first 15 minutes. People are making trades based on the news. Power hour. When we look at the U.S. profiles for example, the three measures move downward in tandem for the first three hours from the market open. They then start to. The time window in which orders are placed is the second hour of trading in the futures contract but the first of the actual, underlying stock market: this. – p.m. While price trends can break either way in the opening hour, they tend to build consensus in the closing hour—barring big news during the trading. The Momentum Trading Strategies can be used from pm but I find the mornings are almost always the best time to trade, specifically the first hour the. This system takes a position in the last hour of the day, holds it overnight, and exits in the first hour of the following trading day. The first hour of any trading session tends to be the most active, as traders react to overnight news and data numbers and stake out advantageous positions. For. Price reaches the day's high and low often within the first minute of the stock's open. Within the first hour of trading, the day's high occurs 49% of the time. End-of-day trading stocks have the most volume and the best setups the hour before close. The stock market slows after the first hour and a half of trading. The markets open at AM EST (New York), during the first hour is where a Day Trader can, and should be making the majority of his profits. They are the first and final hours of the regular trading session. Friday and Monday are typically considered as having the most volatile power hours. The first hour of trading in a nutshell. $IWM. The first hour of trading in a nutshell. $IWM. Image. PM · Jul 25, ·. K. Views. The First Hour: The Initial Balance in Trading. The concept of Initial Balance is important in trading, and traders frequently pay close attention to the price. This trading strategy can be used to enter the market in the last hour of the trading day and exit in the first hour of the next. The 1 Hour Trade: Make Money With One Simple Strategy, One Hour Daily (Langham Trading) [Anderson, Brian P] on boxblog.ru *FREE* shipping on qualifying. See how SPDR S&P ETF Trust (SPY) stock behavior for the first and last hour of the day. Compare performance, volatility and stock volume. The answer: Between to am. Should I Trade in the First Fifteen Minutes? One to two hours of the stock market being open is the best time frame for. Trading outside regular hours is called pre-market and after-hours trading, with pre-market trading hours usually taking place between 8 am and am ET on. The market should rise the most during the first two hours of the trading day after the opening, which is from a.m. until a.m. EST for the NYSE.

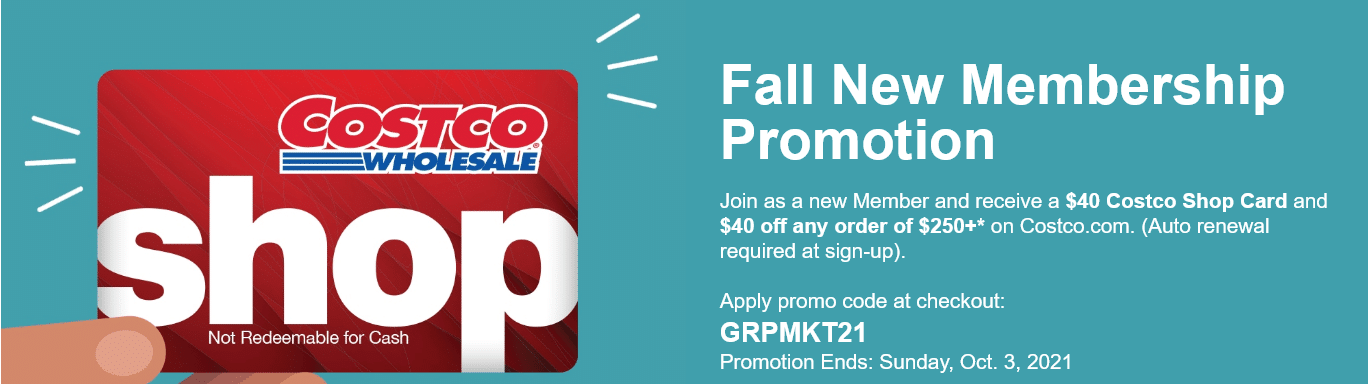

Costco Cheap Membership

Though it isn't discounted, you can currently get yourself a one-year Gold Star membership for $65 on StackSocial and you'll also get a $20 gift card. You can. $25 OFF. For a limited time, Costco members will receive preferred member pricing plus an extra $25 off vehicle glass replacement and repair. Call A Costco Gold Star Membership is $65 a year. An Executive Membership is an additional $65 upgrade fee a year. Each membership includes one free Household Card. Absolutely it's totally worth it! Costco has a markup of only 10% on its items throughout the store, whereas Sam's Club has 15 to 16% markup. At. Best Value & Exclusive Benefits · Annual 2% Reward. Up to $1, on eligible Costco and Costco Travel purchases. · Costco Services Discounts. Additional benefits. Looking for a Costco membership deal or wondering if it's worth the cost? Check out the latest membership deals and find out how to save! Non-members can grab a one-year Gold Star Costco Membership for $60, plus a $20 digital Costco shop card, making the membership fee just $40 out of pocket. You can get special discounts and coupons when you subscribe to Costco's newsletter. Does Costco have a membership program? You can become a Costco member to. About once a year, Groupon runs an epic Costco membership deal where you can get up to $80 in free merchandise. Trust us, you won't want to miss it. Complete. Though it isn't discounted, you can currently get yourself a one-year Gold Star membership for $65 on StackSocial and you'll also get a $20 gift card. You can. $25 OFF. For a limited time, Costco members will receive preferred member pricing plus an extra $25 off vehicle glass replacement and repair. Call A Costco Gold Star Membership is $65 a year. An Executive Membership is an additional $65 upgrade fee a year. Each membership includes one free Household Card. Absolutely it's totally worth it! Costco has a markup of only 10% on its items throughout the store, whereas Sam's Club has 15 to 16% markup. At. Best Value & Exclusive Benefits · Annual 2% Reward. Up to $1, on eligible Costco and Costco Travel purchases. · Costco Services Discounts. Additional benefits. Looking for a Costco membership deal or wondering if it's worth the cost? Check out the latest membership deals and find out how to save! Non-members can grab a one-year Gold Star Costco Membership for $60, plus a $20 digital Costco shop card, making the membership fee just $40 out of pocket. You can get special discounts and coupons when you subscribe to Costco's newsletter. Does Costco have a membership program? You can become a Costco member to. About once a year, Groupon runs an epic Costco membership deal where you can get up to $80 in free merchandise. Trust us, you won't want to miss it. Complete.

MEMBER-ONLY SAVINGS · Costco Direct, Technical Support, and Second-Year Warranty. · ONLINE-ONLY. $ OFF. LIMIT 10 · ONLINE-ONLY. $, OFF. LIMIT 5 EACH. Use the provided single-use promo code when entering your payment information. A Costco Gold Star Membership is $65 a year. An Executive Membership is an. 6. How much does a Costco membership cost? If you want access to all of the benefits of Costco, the warehouse club offers three annual Costco membership. Costco Gold Star Membership Package + $20 Digital Costco Shop Card. from. $65 · Costco Executive Membership Package + $40 Digital Costco Shop Card. from. $ Depending on how much you will spend there in a year you can always get the executive membership. It gives you 2% cash back. New members can save $20 to $40 on a one-year Costco membership thanks to a new deal from Stack Social. Costco Gift of Membership is the perfect gift for your employees, clients, friends and family members. The Gold Star Membership allows them to enjoy savings. New Costco members receive a voucher for up to $ off a $ purchase. Executive memberships ($ off $ purchase): COSTCOMVMEX Gold membership ($60 off. To qualify as a new member, an existing Costco membership must be expired at least 18 months or more. Limit one promotion per household. Digital Costco Shop. When you sign up for a Costco Executive membership, you accrue a 2% annual reward on all qualifying purchases at Costco Travel, Costco warehouses, and Costco. A Costco membership is $60 a year. An Executive Membership is an additional $60 upgrade fee a year. Each membership includes one free Household Card. May be. Executive Membership: $ Annual membership fee ($65 membership fee, plus $65 upgrade fee)* Includes a free Household Card Valid at all Costco locations. check Receive a $40 or $20 Digital Costco Shop Card* when you join Costco as a new Executive or Gold Star member and enroll in auto renewal of your annual. With the Executive Membership, you get 2% cash-back on most purchases made at Costco. So you can pretty much earn the membership cost back by the end of the. You can currently get a FREE $20 Costco gift card when you purchase a Costco Gold Star membership! This is a really great deal and they usually only offer $ If you go as a guest, you'll also be able to buy things you find. Ask the cashier for a subtotal if you want to pay back your member friend. New Gold Star Members receive $ To get these great discounts, simply verify your ID, use the unique ID number on the front of your card, and enter your first. Costco New Gold Star Members receive a $20 Digital Costco Shop Card* - UNiDAYS student discount September · Costco. A Costco Gold Star Membership is $65 a year. An Executive Membership is an additional $65 upgrade fee a year. Each membership includes one free Household Card. Costco Gold Star membership costs $65 per year. Executive membership costs $ per year. Costco Gold star membership includes perks like special pricing on.

Best Commission Free Trading

These are the best online brokers that offer commission-free trading for stocks, mutual funds, ETFs, and sometimes other types of securities. Access global financial markets commission-free and hassle-free. Start with Lookking good BUT Cant use with real money. Since my friend show me the. Ally Invest has a lot that investors will like, such as its commission-free stock and ETF trades, 24/7 customer service and trading platform, which more active. T&Cs apply. Enjoy 0* commission US options trading plus get up to 7%^ USD Moneybull interest up to 90 days with returns up to USD1,! Plus, receive up to. IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. For trades in non-exchange-listed US stocks (e.g. Pink sheet and OTCBB). Why we like it. Robinhood took the concept of discount broker to a whole new level when it launched its commission-free trading platform back in Fidelity. "Fidelity Becomes the Only Firm That Offers Zero Commission Online Trading, Automatic Default to Higher Yielding Cash Option for New Accounts and. This page contains a list of all US-listed ETFs and ETNs that are available for commission free trading on certain select platforms. Some online trading platforms like Robinhood and Webull offer commission-free trading for stocks and ETFs. These platforms have gained. These are the best online brokers that offer commission-free trading for stocks, mutual funds, ETFs, and sometimes other types of securities. Access global financial markets commission-free and hassle-free. Start with Lookking good BUT Cant use with real money. Since my friend show me the. Ally Invest has a lot that investors will like, such as its commission-free stock and ETF trades, 24/7 customer service and trading platform, which more active. T&Cs apply. Enjoy 0* commission US options trading plus get up to 7%^ USD Moneybull interest up to 90 days with returns up to USD1,! Plus, receive up to. IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. For trades in non-exchange-listed US stocks (e.g. Pink sheet and OTCBB). Why we like it. Robinhood took the concept of discount broker to a whole new level when it launched its commission-free trading platform back in Fidelity. "Fidelity Becomes the Only Firm That Offers Zero Commission Online Trading, Automatic Default to Higher Yielding Cash Option for New Accounts and. This page contains a list of all US-listed ETFs and ETNs that are available for commission free trading on certain select platforms. Some online trading platforms like Robinhood and Webull offer commission-free trading for stocks and ETFs. These platforms have gained.

Download now and start investing today. Invest on your terms. • Enjoy commission-free online US-listed stock, ETF, and options trades E*Trade is a great. Just $ per contract with commission-free trades, plus margin rates as low as %. Also named Best for mobile app, advisory services, and fees in the. Here you'll find Schwab's pricing, account fees, and commissions. Our new commission-free trading makes trading stocks, ETFs, and options easier than ever. Before Robinhood and other commission free trading and inve sting platforms, investors were charged transaction fees for each trade, and some platforms. Build your portfolio starting with just $1. Invest in stocks, options, and ETFs at your pace and commission-free. Trade stocks on Webull with no commission fees. Access powerful trading tools and insights to support your strategy. Experience all the power of TradeStation now with commission-free trading on Stocks, ETFs & Options. Get Choose the pricing plan that best suits your needs. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access. Best in Class Platform. Best API Solution. Best API Solution · Best Building with the Alpaca API can make stock trading commission-free. OAuth. Commission-free online trades apply to trading in U.S. listed stocks, Exchange-Traded Funds (ETFs), and options. Option trades are subject to a $ per-. Commission-free trading is on the rise in the UK but it's still not offered by every broker. Given that, you are right to wonder what allows the stockbrokers. Get 1% extra without Robinhood Gold, every year. $0. All trades are commission-free. (other fees may apply). E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. Just $ per contract with commission-free trades, plus margin rates as low as %. Also named Best for mobile app, advisory services, and fees in the. This page contains a list of all US-listed ETFs and ETNs that are available for commission free trading on certain select platforms. The idea of commission-free trading sounds too good to be true, and it many cases it may be. It begs the question of how zero commission brokers actually make. Here at CAPEX, you can expect to have an exceptional CFD trading experience as we offer the highest leverage with the lowest commission. There are $0 commissions on your first online stock or ETF trades each year, in addition to no account or trade minimums. When you combine these benefits. There are several brokers that offer commission-free stock trading, including: 1. Robinhood 2. E*TRADE 3. TD Ameritrade 4. Charles Schwab 5. Get commission-free online trades good for two years. Enroll and make a qualifying net deposit of $, (cash or securities) in your account to earn.

How Do You Get Things Taken Off Your Credit Report

You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. You can also file a dispute directly with the creditor. The Fair Credit Reporting Act (FCRA) allows you to dispute any information in your credit reports. It. You do not need to pay an agency to remove the, you can do it yourself by contacting the credit reference agency, or, failing that, the. You may use the Federal Trade Commission's sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items. Ask the credit reporting agency for a dispute form or submit your dispute in writing along with copies of any supporting documents. Keep a copy of what you send. That the account does, for sure, does have to have dispute wording removed. · Which credit bureaus show the account as disputed. It takes at least one month to remove an inaccurate negative entry from your credit report. You must file a dispute with the credit bureaus or creditor, and. If there's little room to dispute a default but you're wondering how to remove items from your credit report yourself, you can try to reach out to your lender. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. You can also file a dispute directly with the creditor. The Fair Credit Reporting Act (FCRA) allows you to dispute any information in your credit reports. It. You do not need to pay an agency to remove the, you can do it yourself by contacting the credit reference agency, or, failing that, the. You may use the Federal Trade Commission's sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items. Ask the credit reporting agency for a dispute form or submit your dispute in writing along with copies of any supporting documents. Keep a copy of what you send. That the account does, for sure, does have to have dispute wording removed. · Which credit bureaus show the account as disputed. It takes at least one month to remove an inaccurate negative entry from your credit report. You must file a dispute with the credit bureaus or creditor, and. If there's little room to dispute a default but you're wondering how to remove items from your credit report yourself, you can try to reach out to your lender. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more.

It may find that the information is correct and leave your credit report unchanged, update your credit report with corrected information, or remove the disputed. Credit reporting agencies have toll-free numbers to handle consumer disputes about erroneous items in their credit files that aren't removed through the normal. If you have a debt settlement noted on your credit report, you might wonder if you can remove that entry. Unfortunately, the answer is no in most cases. If your credit reports contain errors or outdated information, here's how to dispute those items with the credit reporting bureaus. Your credit reports can. "The only items you can force off of your credit report are those that are inaccurate and incomplete," says McClelland. "Anything else will be at the discretion. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. If there's little room to dispute a default but you're wondering how to remove items from your credit report yourself, you can try to reach out to your lender. You can't ask the credit bureaus or creditors to remove any information that is correct and current, even if it negatively affects your credit score. How Long. However, if your dispute results in items being changed or removed from your credit report, your score may change due to that. Why did the disputed item not. If a collection is accurately reported on your credit report, a dispute (whether initiated by you or a credit repair service) won't remove it. The only ways to. 1. Request your credit reports · 2. Review your credit reports · 3. Dispute credit report errors · 4. Pay off any debts. Want to know how to remove dispute comments from your credit report? It's easier than you might think. To remove disputes from a credit report (for free) you. If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported for Credit Report - In general, the Bankruptcy Court does not control the actions of credit reporting agencies. Debtors must directly contact credit reporting. You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports. The law says you can. Review your credit report and if you find information on it that you think is wrong, you have a right to ask the credit reporting agency or the credit provider. If a collection is accurately reported on your credit report, a dispute (whether initiated by you or a credit repair service) won't remove it. The only ways to. 2. Reporting errors · Mistakes with your personally identifiable information (PII) — like an incorrect name, address, or phone number · Jumbled account.

Is Charles Schwab A Good Checking Account

The Schwab Bank Investor Checking account is available only as a linked account with a Schwab One® brokerage account. The Schwab One brokerage account has no. Charles Schwab is more than a brokerage. It also offers high yield checking and savings interest rates that might far surpass your local bank. Read on to learn. Pros. The checking account bears interest. The bank provides unlimited reimbursement of ATM fees. There's no minimum balance requirement. Charles Schwab offers the High Yield Investor Checking® account, which comes with unlimited ATM-fee reimbursements worldwide and earns interest on your balance. ✓Schwab (boxblog.ru): In my opinion, this is the single best checking account available. Schwab offers a stunningly good account. Checking and savings accounts are accessible, safe places to keep your money, but they will not grow your wealth significantly. Saving and investing are easier. Narrator: Schwab Bank Investor Checking™—the checking account built for investors. On-screen text: Disclosure: Charles Schwab received the highest score in. Overall, Charles Schwab Bank checking account is strongly recommended based on community reviews that rate customer service and user experience. Circle check. Undoubtedly the absolute best bank I have ever used. When you call in, you speak to a representative in the US on first request - who are extremely. The Schwab Bank Investor Checking account is available only as a linked account with a Schwab One® brokerage account. The Schwab One brokerage account has no. Charles Schwab is more than a brokerage. It also offers high yield checking and savings interest rates that might far surpass your local bank. Read on to learn. Pros. The checking account bears interest. The bank provides unlimited reimbursement of ATM fees. There's no minimum balance requirement. Charles Schwab offers the High Yield Investor Checking® account, which comes with unlimited ATM-fee reimbursements worldwide and earns interest on your balance. ✓Schwab (boxblog.ru): In my opinion, this is the single best checking account available. Schwab offers a stunningly good account. Checking and savings accounts are accessible, safe places to keep your money, but they will not grow your wealth significantly. Saving and investing are easier. Narrator: Schwab Bank Investor Checking™—the checking account built for investors. On-screen text: Disclosure: Charles Schwab received the highest score in. Overall, Charles Schwab Bank checking account is strongly recommended based on community reviews that rate customer service and user experience. Circle check. Undoubtedly the absolute best bank I have ever used. When you call in, you speak to a representative in the US on first request - who are extremely.

The Schwab Bank Investor Savings account has no minimum deposit, making it a good choice for those just starting out who may struggle to come up with the high. You can withdraw money using checks and a linked debit card, and you get up to $5 million in FDIC insurance on your cash balance. There are no account fees or. What is the Charles Schwab savings account interest rate? The Schwab Bank Investor Savings account has a % APY. · Is Charles Schwab a good high-yield savings. If you're looking to expand your relationship from just a brokerage account to a bank account, you can have that set up in minutes on the Schwab site. You'll. Charles Schwab Bank's checking account pays interest, and there are no overdraft fees. You cannot deposit cash into a Schwab account, even by going to a branch;. Charles Schwab · No fees or account minimums make it competitive for people entering the financial world. · Schwab also has travel features such as (1) no foreign. ✓Schwab (boxblog.ru): In my opinion, this is the single best checking account available. Schwab offers a stunningly good account. Now, GOBankingRates has ranked Charles Schwab Bank as having one of the Best Checking Accounts of Charles Schwab Bank: Key Features. Charles Schwab. The Schwab Bank High Yield Investor Checking Account is another good option if you'd like to open a checking account with a familiar brand. In particular, this. Who's this for? Charles Schwab offers the High Yield Investor Checking® account, which comes with unlimited ATM-fee reimbursements worldwide and earns interest. #1 in Customer Satisfaction for Direct Bank Checking Accounts 6 Years in a Row. Charles Schwab received the highest score in the checking segment of the J.D. Schwab Bank Investor Checking Account Summary of Features, Fees and Rates · Schwab Bank Investor Checking Account Summary of Features, Fees and Rates · Privacy. The banking experience has generally been very good as compared to the mainstream banks. But you should think long and hard about whether you need a brick and. 1. The Annual Percentage Yield (APY) on the Schwab Bank Investor Savings™ account, with a minimum balance of $, offers a % annual percentage yield. Funds deposited at Charles Schwab Bank, SSB, are insured, in aggregate, up to $,, based on account ownership type, by the Federal Deposit Insurance. Schwab Bank's Investor Checking account has no account maintenance or activity fees. Fees may be assessed for additional services such as custom check orders. Opening a checking account is a fundamental step in managing your personal finances. Charles Schwab, known primarily for its investment. Opening a checking account is a fundamental step in managing your personal finances. Charles Schwab, known primarily for its investment. The Schwab debit card has no foreign transaction fees, and ATM fees are reimbursed around the globe with no limit. The bottom line is those perks, plus fee-free. Charles Schwab is more than a brokerage. It also offers high yield checking and savings interest rates that might far surpass your local bank. Read on to learn.

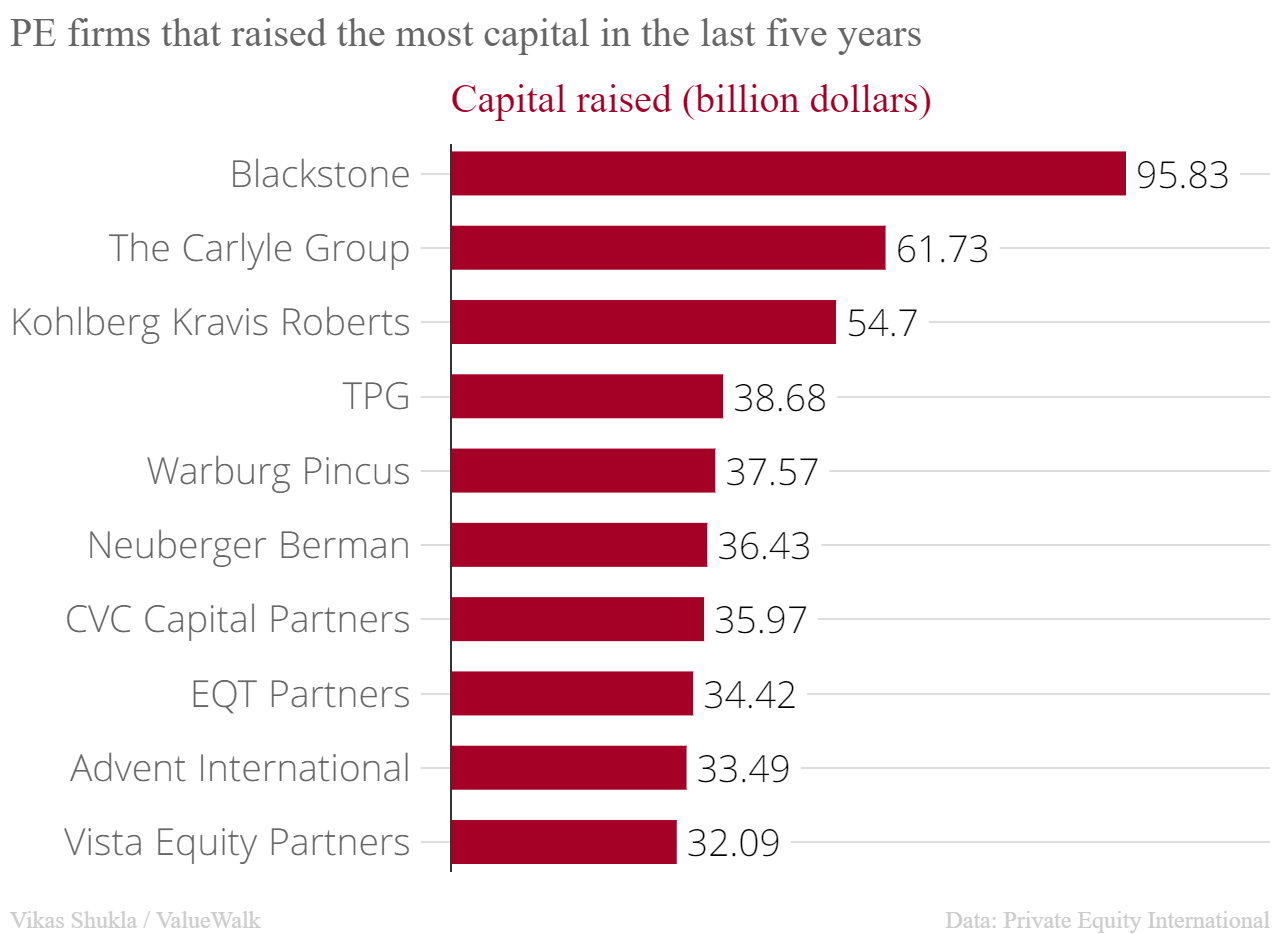

Largest Private Equity Investors

We invest in enterprise software, data and technology companies through private equity, permanent capital, credit and public equity investment strategies. Blackstone is the world's largest alternative asset manager, serving institutional and individual investors by building strong businesses positioned to. Bain Capital, one of the world's leading private multi-asset alternative investment firms, manages approximately $75 billion in assets. KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. LPs appear to be investing more capital with a smaller number of proven and well-known GPs, with the largest funds accounting for a greater proportion of. Advent is one of the largest and most experienced global private equity firms, with deep sector expertise. By far the largest private equity owner and operator of hospitals is Apollo Global Management. We tracked at least hospitals through Apollo's two health. The typical PE fund has failed to outperform the stock market since at least o yet the four biggest PE firms collected $ billion in performance fees. Explore the world's largest private equity firms. These financial lighthouses have immense influence from technology startups to established healthcare. We invest in enterprise software, data and technology companies through private equity, permanent capital, credit and public equity investment strategies. Blackstone is the world's largest alternative asset manager, serving institutional and individual investors by building strong businesses positioned to. Bain Capital, one of the world's leading private multi-asset alternative investment firms, manages approximately $75 billion in assets. KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. LPs appear to be investing more capital with a smaller number of proven and well-known GPs, with the largest funds accounting for a greater proportion of. Advent is one of the largest and most experienced global private equity firms, with deep sector expertise. By far the largest private equity owner and operator of hospitals is Apollo Global Management. We tracked at least hospitals through Apollo's two health. The typical PE fund has failed to outperform the stock market since at least o yet the four biggest PE firms collected $ billion in performance fees. Explore the world's largest private equity firms. These financial lighthouses have immense influence from technology startups to established healthcare.

Largest Private Equity Deals · 1. RJR Nabisco ( $31B) (Inflation Adjusted: $B) · 2. TXU Energy ( $B) (Inflation Adjusted: $B) · 3. Equity. Leading database of private equity and venture capital investors at your fingertips boxblog.ru is a fast and easy-to-use platform to identify. Morgan Stanley Private Equity; Morgenthaler Partners; One Equity Partners; PAG Asia Capital; Pantheon Ventures; Platinum Equity; Primus Capital Funds. A leading global private equity firm. TA fosters collaborative partnerships with teams and stakeholders that build outstanding businesses with lasting. This image shows the top 50 private equity firms based on how much money they've raised between and The biggest advantages of MM PE firms are: Autonomy: There's less hierarchy, so you'll have more responsibility on deals and with portfolio companies. And you'. The PERE 50 measures equity raised between 1 January. and mid-April for direct real estate investment through closed-ended, commingled real estate. Thoma Bravo is a leading private equity firm. Top Private Equity Firms for the Mid-Market · L Catterton · MSouth Equity Partners · Vista Equity Partners LLC · Nautic Partners · First Capital Partners. Warburg Pincus LLC is a leading global growth investor. The firm has an active portfolio of more than companies and is headquartered in New York. 1. Thoma Bravo Thoma Bravo is a leading software investment firm with over $ billion in assets under management as of March 31, fund means that private equity firms gain know-how fast. Permira, one of the largest and most successful European private equity funds, made more than Leading · Advent International · Ardian · Cinven · Deutsche Beteiligungs Ag · EQT · Partners Group · Quadriga Capital · Triton. Private-equity firms · Blackstone Inc. · Kohlberg Kravis Roberts · EQT AB · CVC Capital Partners · TPG Capital · The Carlyle Group · Thoma Bravo · Advent International. The Blackstone Group Inc. is one of the biggest names in the industry. It was founded in by Peter G. Peterson and Stephen A. Schwarzman. It remained. In fact, the largest investors in private equity are public pension funds, meaning teachers, firefighters, and other public employees are the biggest. equity solutions to sponsor-controlled North American and European platforms. We are partners in growing leading companies. +. Platform Investments. 1,+. 1 Excludes secondaries, funds of funds, and co-investment vehicles to avoid double counting of capital fundraised. 2 Other private equity includes. Bain Capital, LP is one of the world's leading private investment firms with approximately $ billion of assets under management that creates lasting impact.