boxblog.ru

Gainers & Losers

Can You Borrow Cryptocurrency

Unlike traditional loans that consider your credit score, Nexo offers crypto-backed credit lines, using your digital assets as collateral. In essence, you. Crypto borrowing is a process that allows for liquidity without the need to sell crypto assets. DeFi loans are a crucial part of crypto borrowing. YouHodler provides their users with an option to get a loan using crypto or stablecoins assets as collateral. In return, the user instantly receives an agreed. You can now borrow against your crypto starting at only % APR and take advantage of Celsius's lowest loan rates ever at each LTV. Crypto lending is a financial transaction where one party lends cryptocurrency to another party in exchange for compensation. Get an instant crypto-backed loan with APX Lending, your global crypto-backed lender offering safe, secure, no-credit-check loans for instant liquidity in. Crypto loans allow users to borrow fiat currency or other cryptocurrencies using their crypto holdings as collateral. The borrower agrees to pay back the loan. Crypto borrowing is a process that allows for liquidity without the need to sell crypto assets. DeFi loans are a crucial part of crypto borrowing. To borrow a loan: · Log In to your boxblog.ru Exchange account · Go to Dashboard > Lending > Loans · Tap Take Out a New Loan to apply for a loan. Unlike traditional loans that consider your credit score, Nexo offers crypto-backed credit lines, using your digital assets as collateral. In essence, you. Crypto borrowing is a process that allows for liquidity without the need to sell crypto assets. DeFi loans are a crucial part of crypto borrowing. YouHodler provides their users with an option to get a loan using crypto or stablecoins assets as collateral. In return, the user instantly receives an agreed. You can now borrow against your crypto starting at only % APR and take advantage of Celsius's lowest loan rates ever at each LTV. Crypto lending is a financial transaction where one party lends cryptocurrency to another party in exchange for compensation. Get an instant crypto-backed loan with APX Lending, your global crypto-backed lender offering safe, secure, no-credit-check loans for instant liquidity in. Crypto loans allow users to borrow fiat currency or other cryptocurrencies using their crypto holdings as collateral. The borrower agrees to pay back the loan. Crypto borrowing is a process that allows for liquidity without the need to sell crypto assets. DeFi loans are a crucial part of crypto borrowing. To borrow a loan: · Log In to your boxblog.ru Exchange account · Go to Dashboard > Lending > Loans · Tap Take Out a New Loan to apply for a loan.

Borrow Using Cryptocurrency. A crypto-backed loan is a collateralized loan that you can get through a crypto exchange or some other crypto lending platform. The. Get an instant crypto-backed loan with APX Lending, your global crypto-backed lender offering safe, secure, no-credit-check loans for instant liquidity in. Details vary by lender, but some lenders are willing to credit up to 90% of your crypto assets toward their reserve requirement. To qualify, you must have your. Crypto lending is when you lend your cryptocurrency funds to borrowers in exchange for interest payments. Crypto Loan Platforms. Get a loan using your Bitcoin and other crypto as collateral. Lend your Bitcoin and crypto to earn interest. Crypto lending is the process of depositing cryptocurrency that is lent out to borrowers in return for regular interest payments. Borrow against your crypto in · 1. Create your account. Complete registration to easily return to your application. · 2. Send collateral. Choose your desired. Borrowing crypto on Binance is easy! Use your cryptocurrency as collateral to get a loan instantly without credit checks. Use your cryptocurrencies as collateral for loans up to €1 million. Get cash by holding your cryptocurrencies with immediate approval. No credit checks; No. Borrow Using Cryptocurrency. A crypto-backed loan is a collateralized loan that you can get through a crypto exchange or some other crypto lending platform. The. A SALT loan is an asset-backed loan in which your cryptoassets act as collateral for your line of credit. With crypto lending, borrowers use their digital assets as collateral, similar to how a house is used as collateral for a mortgage. To get a crypto-backed loan. What you should know about crypto loans · You choose the conditions: the crypto coin as collateral, the coin in which you want to get your crypto backed loan and. Just open and verify your account, deposit your crypto to the wallet and use it as collateral for your future BTC loans. If you would like to learn more about. Bitcoin loans are, in essence, a type of lending where Bitcoin is used as collateral. Many lenders who accept Bitcoin also accept other cryptocurrencies. It's. Crypto lending involves the use of cryptocurrency. These digital assets are built on decentralized blockchain technology, which can help make them more. What is a Crypto-Backed Loan? Crypto loans have terms of a few weeks or months, and you will be able to borrow for around two years at maximum. Enness'. Get an instant loan for Bitcoin, Ethereum, Litecoin, etc. Borrow crypto in USDT or USDC in a few minutes without any delays! Arch is the leading crypto lending platform for individuals and institutions known for its concierge customer service, premier product experience. In a nutshell, yes – crypto loans without collateral are possible. There are now numerous ways to do this, and it's a process that makes cryptocurrency more.

How To Use Your 401k Money

Typically, you have to repay money you've borrowed from your (k) within five years by making regular payments of principal and interest at least quarterly. With a (k), an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Participants can. Your employer automatically withholds a portion of each paycheck and puts it into the account. With a traditional tax-deferred (k), this money is taken out. If you are under 59 ½ and are still working under covered employment, you can apply for a hardship withdrawal. Participants can withdraw certain employer. If your plan allows, you may take a (k) loan for half of your vested balanced up to $50, There is no tax penalty, but you may pay a nominal one-time or. Both plans allow pre-tax money to grow tax-deferred until it is withdrawn and then it is taxed at their marginal rate. How to Bring ks and IRAs to Canada. Depending on the basis of company matching contributions (traditional or Roth, if offered), taxes on these contributions and any earnings on them may be due. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Typically, you have to repay money you've borrowed from your (k) within five years by making regular payments of principal and interest at least quarterly. With a (k), an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Participants can. Your employer automatically withholds a portion of each paycheck and puts it into the account. With a traditional tax-deferred (k), this money is taken out. If you are under 59 ½ and are still working under covered employment, you can apply for a hardship withdrawal. Participants can withdraw certain employer. If your plan allows, you may take a (k) loan for half of your vested balanced up to $50, There is no tax penalty, but you may pay a nominal one-time or. Both plans allow pre-tax money to grow tax-deferred until it is withdrawn and then it is taxed at their marginal rate. How to Bring ks and IRAs to Canada. Depending on the basis of company matching contributions (traditional or Roth, if offered), taxes on these contributions and any earnings on them may be due. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan.

The only other way to get access to your funds is to leave your employer. Disadvantages of Closing Your k. The IRS allows individuals to cash out their k. Complete paperwork, usually referred to as a “Distribution Request Form” · Provide instructions verbally by calling your plan's service provider · Enter your. How to set up your withdrawals · 1. Set up a money market account · 2. If you're the Required Minimum Distribution (RMD) age of 73*, take your distributions. · 3. Use this form to request a one-time withdrawal from a Fidelity Self-Employed (k), Profit Sharing, or Money Purchase Plan account. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. In addition, the benefit to utilizing a traditional k is that you get to set aside money on a pre-tax basis. If you borrow a k loan, you pay yourself back. Depending on the type of benefit distribution provided under your (k) plan, the plan may also require the consent of your spouse before making a distribution. Rollovers as Business Startups (ROBS): If you have over $50, in your (k), you may be able to use the money to invest in your business. While ROBS aren't a. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of. How does a (k) loan work? With most loans, you borrow money from a lender with the agreement that you will pay back the funds, usually with interest, over. Upon retirement, you have the option to leave your money in your (k), transfer it to an IRA, withdraw a lump sum, convert it into an annuity, or take. You can take withdrawals from the designated (k), but once you roll that money into an IRA, you can no longer avoid the penalty. And if you've been. You can decide to take a lump-sum distribution, take a periodic distribution (either monthly or quarterly), buy an annuity, or rollover the retirement savings. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. I did it and got the money within a week. They took out 10% for their fees. I got the tax form in the mail the next year and the amount of money. There are no penalty exemptions for the purchase of a new home, so the money you take out of your (k) to help pay for your house would be subject to the You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You.

Lenders That Offer Construction Loans

:max_bytes(150000):strip_icc()/BestConstructionLoanLenders-170b2df126b748adac6972b312c0452e.jpg)

Two Close Construction: Two-close construction loans only eligible for primary residence. Required loan term 18 months. Additional fees and terms may apply if. As one of the largest construction loan lenders in the Kansas City area, North American Savings Bank offers innovative finance programs for both the. Banks and credit unions: Many traditional banks and credit unions offer construction loans, and they may be able to offer you competitive. Solvay Bank Construction Loans · Up to day rate lock at no charge · Flexible loan options · Loans up to $1 million* · Loans over $1 million available with. We combine your construction loan and permanent mortgage into one loan. You only have one closing and pay just one set of costs. Once your construction is. New Construction Loans Let's build something together! When it comes to new construction, think of this as your “Swiss Army Knife” loan. It's one loan that. With a TD Bank construction to permanent loan you can expect: · Fixed or adjustable rate options · Flexible down payment options · An initial loan payment. Get an instant quote on a home construction loan. Check rates and learn more about MACU construction loans. Find your perfect loan now. Our construction loans and draws are handled locally, and we offer monthly interest-only payments based on your construction loan balance. When your home is. Two Close Construction: Two-close construction loans only eligible for primary residence. Required loan term 18 months. Additional fees and terms may apply if. As one of the largest construction loan lenders in the Kansas City area, North American Savings Bank offers innovative finance programs for both the. Banks and credit unions: Many traditional banks and credit unions offer construction loans, and they may be able to offer you competitive. Solvay Bank Construction Loans · Up to day rate lock at no charge · Flexible loan options · Loans up to $1 million* · Loans over $1 million available with. We combine your construction loan and permanent mortgage into one loan. You only have one closing and pay just one set of costs. Once your construction is. New Construction Loans Let's build something together! When it comes to new construction, think of this as your “Swiss Army Knife” loan. It's one loan that. With a TD Bank construction to permanent loan you can expect: · Fixed or adjustable rate options · Flexible down payment options · An initial loan payment. Get an instant quote on a home construction loan. Check rates and learn more about MACU construction loans. Find your perfect loan now. Our construction loans and draws are handled locally, and we offer monthly interest-only payments based on your construction loan balance. When your home is.

Building a new home or making major renovations? Lucky for you, our lenders are experienced in construction loans We offer a seamless loan or deposit account. Build your dream home with a Citizens construction-to-permanent financing loan. Our program lets you combine your construction financing and mortgage into. Build the home you've always wanted with a One-Time Close Construction Loan. We also offer Residential Lot Loans to purchase improved land. Can they offer ideas and guidance throughout the entire building process? bank will begin to fund the builder's draw requests from your construction loan. Learn more about new construction loans and what to consider when looking to finance your dream home with help from U.S. Bank. Benefits & Features · Flexible terms and competitive rates · Construction loan amounts up to 80% of acquisition cost and % of construction cost · Daily. Construction Loans · We'll walk you through the process; You can expect fast and local approvals · Home is built based on your customized plans and. Construction Loans · Short-term loan that covers building materials and labor · Affordable rates and low closing costs · Down payment as low as 5% · Access to. Get in touch with one of our lenders to discover a home construction or homesite loan package that fits your needs. Texas Farm Credit offers: Construction. Our construction loans and draws are handled locally, and we offer monthly interest-only payments based on your construction loan balance. When your home is. ANBTX offers convenient financing for those who want to build—not buy—a new home, designed exclusively for the construction process. You'll get great rates. Best construction loan lenders · Best for in-person service: TD Bank · Best for loan variety: Flagstar Bank · Best for a longer construction period: Citizens™. desktop title. Construction and renovation loans have a few more moving parts than other home loans, but rest assured Umpqua has the experience to help turn. Home builders prefer Timberland Bank construction loans. We can provide construction financing for owner-builder, homes on acreage and more. Already own your lot? We will use the appraised value of the lot to meet equity requirements when calculating your LTV. *Subject to Home Bank credit criteria. Build the home of your dreams with a construction loan from BankSouth! We are more than a lender as we can guide you into a permanent mortgage after. New Construction Loans · Conforming and jumbo loans with as little as 5% down · Interest-only payments during construction · No PMI during construction on. Construction-to-Permanent Loan Lender. Our construction-to-permanent financing covers the entire construction process with a single loan. From acquiring the. Construction and building loans can help you start building your next home. Core Bank can help you find the right option and terms to fit your needs.

Nft Horse Race

Zed Run NFT horseracing game allows you to buy and race digital horses to earn money. This incredible game has been chart-topping since launch. DeFiHorse (DFH) is a horse-racing metaverse based on blockchain technology, where players can buy, sell, breed, take NFT horses to the races to win prizes. In NFT horse racing, you can purchase virtual race horses as NFTs on the blockchain and compete with them for actual money. You can breed various thoroughbreds. Zed Run is a digital blockchain-based horse racing game where users can own, breed, and race digital racehorses with other players from around the world. Lazy Horse Race Club is a collection of NFT which was minted on Jul 23, at the price of 0 ETH. The current floor price is ETH which has. Join the horse racing game and redefine the meaning of GameFi with WIN NFT HORSE! ZED RUN is the first digital horse racing game on the blockchain. Proudly sponsored by NASCAR, Budweiser and ATARI. When you engage in NFT racing, you will buy digital racehorses on a blockchain and will then race those horses against others in virual Metaverse space (sites. Fulfill your lifelong fantasy of winning the Kentucky Derby! Experience the thrill of owning a race horse without any of the hassle. PLAY NOW! Zed Run NFT horseracing game allows you to buy and race digital horses to earn money. This incredible game has been chart-topping since launch. DeFiHorse (DFH) is a horse-racing metaverse based on blockchain technology, where players can buy, sell, breed, take NFT horses to the races to win prizes. In NFT horse racing, you can purchase virtual race horses as NFTs on the blockchain and compete with them for actual money. You can breed various thoroughbreds. Zed Run is a digital blockchain-based horse racing game where users can own, breed, and race digital racehorses with other players from around the world. Lazy Horse Race Club is a collection of NFT which was minted on Jul 23, at the price of 0 ETH. The current floor price is ETH which has. Join the horse racing game and redefine the meaning of GameFi with WIN NFT HORSE! ZED RUN is the first digital horse racing game on the blockchain. Proudly sponsored by NASCAR, Budweiser and ATARI. When you engage in NFT racing, you will buy digital racehorses on a blockchain and will then race those horses against others in virual Metaverse space (sites. Fulfill your lifelong fantasy of winning the Kentucky Derby! Experience the thrill of owning a race horse without any of the hassle. PLAY NOW!

this NFT is changing horse racing. it's called Game of Silks. and they have a massive docs team. and go on public sale April 27th. the project is the first. Compete against other racers in adrenaline-filled online pvp horse racing game where every moment matters. Dominate the Racetrack! Welcome to Zed Run, a digital horse racing universe where players can own MetaMask is an Ethereum crypto wallet commonly used by Non-Fungible Token (NFT). A play-to-earn virtual horse racing ecosystem where you can race against other real life owners and create generations and generations of unique offspring. It is a virtual horse racing e-sport where users can pit their digital horses against others in an NFT horse racing. A #p2e game that combines the virtual and real worlds of horse racing. Racers can BREED, RAISE, TRADE, RACE & WIN! ⚡️Powered by $META. EquineNFT. @EquineNFT. Experience the future of virtual horse racing with our cutting-edge Web 3 Racehorse Management Game. Get ready to race soon! http. Whitepaper. NFT-BASED HORSE RACING, BREEDING AND TRADING GAME. Enter App. RACE Breed your horse with another to produce a brand new horse offspring. We assist you in delivering a handful of promising NFT horse racing gaming projects that widens the possibility of becoming a billionaire. Photo Finish™ LIVE is the most exciting experience in play to earn crypto games with virtual horse racing at its finest. Article: NFT Virtual Horse Racing. In Game of Silks (GoS), You can buy a digital version of a real, live race horse - and win real money as your horse wins real races. What's the difference between this NFT racing game and Zed Run? At the current exchange that is $ US dollars for the cheapest horse you. An NFT Horse Racing Game is an innovative and immersive gaming experience that utilizes non-fungible tokens (NFTs) and revolves around virtual horse racing. In. Horse Racing NFT-Based game. Build a stable of winning racehorses and create a legacy by buying, breeding and racing. Zed Run Clone Script is a pre-built gaming website script that will help you instantly launch your own NFT Horse Racing Game just like Zed Run, where the. When you engage in NFT racing, you will buy digital racehorses on a blockchain and will then race those horses against others in virual Metaverse space (sites. EquineNFT. @EquineNFT. Experience the future of virtual horse racing with our cutting-edge Web 3 Racehorse Management Game. Get ready to race soon! http. Solanart is the first fully-fledged NFT marketplace on Solana. Get quick and easy access to digital collectibles and explore, buy and sell NFTs. Discover the NFT collections that will soon be listed for sale, including the most exciting drops, listed in ascending order based on the release date and. If you are an active entrepreneur in the blockchain space this blog provides insights on launching NFT horse racing games like Zed Run.

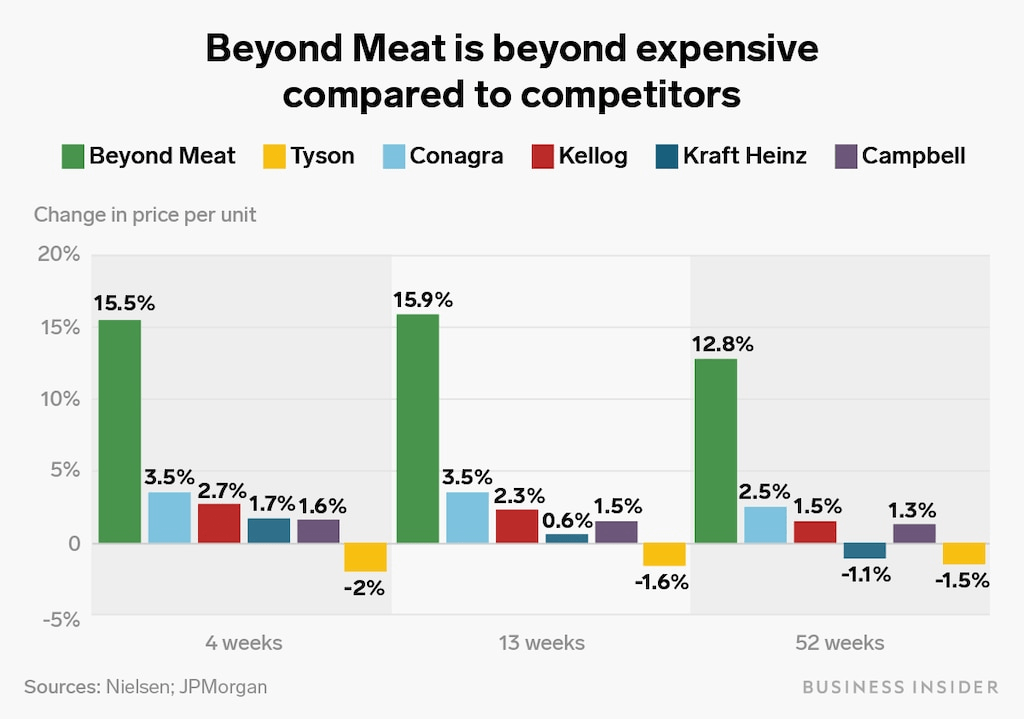

Stock Price Of Beyond Meat

Real time Beyond Meat (BYND) stock price quote, stock graph, news & analysis. BYND Price · $ ; Market Cap · $M ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. Beyond Meat Inc BYND:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date02/28/24 · 52 Week Low · 52 Week. Beyond Meat, Inc., a plant-based meat company, develops, manufactures, markets, and sells plant-based meat products in the United States and internationally. As a result of these disclosures, the price of Beyond Meat stock declined by $ per share, or over %, from $ per share to $ per share. As a. Real-time Price Updates for Beyond Meat Inc (BYND-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. 25 minutes ago. Beyond Meat (NASDAQ:BYND) Surprises With Strong Q2, Guides For Strong Full-Year Sales. Plant-based protein company Beyond Meat (NASDAQGS:BYND) reported Q2. Discover real-time Beyond Meat, Inc. Common Stock (BYND) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Real time Beyond Meat (BYND) stock price quote, stock graph, news & analysis. BYND Price · $ ; Market Cap · $M ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. Beyond Meat Inc BYND:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date02/28/24 · 52 Week Low · 52 Week. Beyond Meat, Inc., a plant-based meat company, develops, manufactures, markets, and sells plant-based meat products in the United States and internationally. As a result of these disclosures, the price of Beyond Meat stock declined by $ per share, or over %, from $ per share to $ per share. As a. Real-time Price Updates for Beyond Meat Inc (BYND-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. 25 minutes ago. Beyond Meat (NASDAQ:BYND) Surprises With Strong Q2, Guides For Strong Full-Year Sales. Plant-based protein company Beyond Meat (NASDAQGS:BYND) reported Q2. Discover real-time Beyond Meat, Inc. Common Stock (BYND) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

BYND Related stocks ; BYND, , %. Beyond Meat Inc ; TSN, , +%. Tyson Foods ; HRL, , +%. Hormel Foods Corp. Find the latest historical data for Beyond Meat, Inc. Common Stock (BYND) at boxblog.ru View historical data in a monthly, bi-annual, or yearly format. Track Beyond Meat Inc (BYND) Stock Price, Quote, latest community messages, chart, news and other stock related information. Beyond Meat Stock (NASDAQ: BYND) stock price, news, charts, stock research, profile. 26 minutes ago. Beyond Meat Inc ; Nov, Downgrade, Consumer Edge Research, Equal Weight → Underweight, $5 ; Oct, Downgrade, Mizuho, Neutral → Underperform, $12 → $5. Beyond Meat, Inc. engages in the provision of plant-based meats. Its products include ready-to-cook meat under The Beyond Burger and Beyond Sausage brands. The current price of BYND is USD — it has decreased by −% in the past 24 hours. Watch Beyond Meat, Inc. stock price performance more closely on the. Get Beyond Meat Inc (BYND.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. See today's BYND stock price for Beyond Meat (NASDAQ: BYND) plus other valuable data points like day range, year, stock analyst insights, and more. On Monday 09/02/ the closing price of the Beyond Meat share was $ on BTT. Compared to the opening price on Monday 09/02/ on BTT of $, this is a. View the real-time BYND price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The Beyond Meat Inc stock price today is What Is the Stock Symbol for Beyond Meat Inc? The stock ticker symbol for Beyond Meat Inc is BYND. Is BYND the. Stock analysis for Beyond Meat Inc (BYND:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Beyond Meat Inc. ; Open. $ Previous Close ; YTD Change. %. 12 Month Change ; Day Range - 52 Wk Range. What was Beyond Meat's price range in the past 12 months? Beyond Meat lowest stock price was $ and its highest was $ in the past 12 months. The average one-year price target for Beyond Meat, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price target is the. Stock analysis for Beyond Meat Inc (BYND:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Market Cap. M ; Volume (3M). M ; Price-Earnings Ratio. ; Revenue. M.

Hypergrowth Stocks

Hypergrowth Investing is a weekly podcast that picks the brain of investment analyst Luke Lango. Each week Luke will take an in depth look at the trending tech. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns A lot of people make buying stocks a lot more. The next edition of the Closelook@US Stock Markets Hypergrowth I find these stocks in the hypergrowth sector, especially secular story. The Hypergrowth Stock concept was introduced in the Harvard Business Review in after a Harvard professor noted that certain No Result. Book overview · The author has identified 12 Hypergrowth Stocks that are poised to be big winners — tenbaggers, even hundredbaggers — over the next decade. Description. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns. A lot of people make buying stocks. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns. A lot of people make buying stocks a lot more. 5 Cheap Hyper-Growth Micro- And Small-Cap Sep. 19, AM ETNTWK, RVLT, 19, AM ETNTWK, RVLT, STTO, SUNWQ, EDUC33 Comments 1 Like. 2 Hypergrowth Stocks to Buy in and Beyond. Motley Fool - Fri Jan 7, The stocks for ServiceNow (NYSE: NOW) and Upstart Holdings (NASDAQ: UPST) had. Hypergrowth Investing is a weekly podcast that picks the brain of investment analyst Luke Lango. Each week Luke will take an in depth look at the trending tech. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns A lot of people make buying stocks a lot more. The next edition of the Closelook@US Stock Markets Hypergrowth I find these stocks in the hypergrowth sector, especially secular story. The Hypergrowth Stock concept was introduced in the Harvard Business Review in after a Harvard professor noted that certain No Result. Book overview · The author has identified 12 Hypergrowth Stocks that are poised to be big winners — tenbaggers, even hundredbaggers — over the next decade. Description. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns. A lot of people make buying stocks. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns. A lot of people make buying stocks a lot more. 5 Cheap Hyper-Growth Micro- And Small-Cap Sep. 19, AM ETNTWK, RVLT, 19, AM ETNTWK, RVLT, STTO, SUNWQ, EDUC33 Comments 1 Like. 2 Hypergrowth Stocks to Buy in and Beyond. Motley Fool - Fri Jan 7, The stocks for ServiceNow (NYSE: NOW) and Upstart Holdings (NASDAQ: UPST) had.

Find & Download the most popular Hypergrowth Stocks Photos on Freepik ✓ Free for commercial use ✓ High Quality Images ✓ Over 55 Million Stock Photos. Buy Hypergrowth Stocks For Hyperprofits: Edition is for investors who are fed up with mediocre and pathetic returns. Image 1 of Buy Hypergrowth Stocks For Hyperprofits: Edition (Paperback). USD$ You save $ Out of stock. Notify me when it is back in stock. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns. A lot of people make buying stocks a lot more. boxblog.ru: Buy Hypergrowth Stocks For Hyperprofits: Edition: Mailhiot, Derek: Books. Buy Hypergrowth Stocks For Hyperprofits is for investors who are fed up with mediocre and pathetic returns! A lot of people make buying stocks a lot more. Forget Nvidia: Billionaires Are Seemingly Infatuated With These 2 Hypergrowth Stocks Instead. Sep. 10, at a.m. ET on Motley Fool. NIO Stock Gains. Hyper Growth Stocks · 1. Waaree Renewab. , , , , , , , , , , · 2. Macfos, , What is hypergrowth? Far from a buzzword, however, hypergrowth represents a concrete, well-defined stage in a company's growth cycle. Why Tom Lee says investors should be rotating out of 'hyper-growth stocks'. Published Thu, Apr 1 PM EDT Updated Thu, Apr 1 PM EDT. Hypergrowth Investing. @HypergrowthInvesting. K subscribers•79 videos 4 Quantum Computing Stocks to Buy as Growth Stocks BOOM. K views. 1 year. Hypergrowth Investing is a weekly podcast that picks the brain of investment analyst Luke Lango. Each week Luke will take an in depth look at the trending tech. Buy These 3 Hypergrowth Stocks to Play the Hydrogen Economy's $11 TRILLION Breakout. I've always been super keen on dividend stock, build up equity steadily that way, but I'm in my mid 30's and want to take a different approach. Hypergrowth stocks are a subset of growth stocks whose underlying business is growing at a high-double-digit to triple-digit pace. Predictably, hypergrowth. 2 Hypergrowth Stocks to Buy in and Beyond · 1. Nvidia · 2. Microsoft. Microsoft (NASDAQ: MSFT) is the world's second-. Request PDF | Hype over fundamentals: how the shift to hyper-growth stocks created a bubble in the American equity markets | From to financial. Let's have a look at several exciting hypergrowth stocks. The first one is CrowdStrike. According to analysts from Statista, the cybersecurity industry is. 3 Hypergrowth Stocks to Buy in and Beyond | $NU $DUOL $CRWD The Motley Fool boxblog.ru Hypergrowth Investing. InvestorPlace. (9); INVESTING; UPDATED WEEKLY stocks, China stocks, notable emerging market stocks, and sports betting stocks.

Ac Compressor Replacement Labor Cost

A compressor replacement is on the higher end of the spectrum when considering the average cost of AC repair. Labor costs $75 to $ per hour, and an AC. An AC compressor costs upwards of $1, on average, with the cheapest models priced at $80o. This is exclusive of the labor costs in installing air. However, in general, air compressor replacement and labor cost would be approximately $ to $1, On average, the cost for a Ford Fusion Car AC Compressor Replacement is $ with $ for parts and $ for labor. Prices may vary depending on your location. You need to consider the cost of replacing an AC unit and a compressor as well. Depending on the speed of the compressor and the size of the air conditioning. An AC compressor costs upwards of $1, on average, with the cheapest models priced at $80o. This is exclusive of the labor costs in installing air. And the technicians take $$ per hour as the labor cost of replacing a refrigerator compressor. AC Compressor Replacement Cost Breakdown ; Expense, Typical Cost ; Compressor Part, $ - $2, ; Labor, $ - $ ; Supplementary Components, $ - $ So, here is the repair cost of different parts of a compressor. On average, it comes to about $ to $ If you have an HVAC, then the cost of repair can be. A compressor replacement is on the higher end of the spectrum when considering the average cost of AC repair. Labor costs $75 to $ per hour, and an AC. An AC compressor costs upwards of $1, on average, with the cheapest models priced at $80o. This is exclusive of the labor costs in installing air. However, in general, air compressor replacement and labor cost would be approximately $ to $1, On average, the cost for a Ford Fusion Car AC Compressor Replacement is $ with $ for parts and $ for labor. Prices may vary depending on your location. You need to consider the cost of replacing an AC unit and a compressor as well. Depending on the speed of the compressor and the size of the air conditioning. An AC compressor costs upwards of $1, on average, with the cheapest models priced at $80o. This is exclusive of the labor costs in installing air. And the technicians take $$ per hour as the labor cost of replacing a refrigerator compressor. AC Compressor Replacement Cost Breakdown ; Expense, Typical Cost ; Compressor Part, $ - $2, ; Labor, $ - $ ; Supplementary Components, $ - $ So, here is the repair cost of different parts of a compressor. On average, it comes to about $ to $ If you have an HVAC, then the cost of repair can be.

The average cost for a Ford E Super Duty AC Compressor Replacement is between $ and $ Labor costs are estimated between $ and $ while parts. Labor Costs For AC Compressor Replacement. The labor expense to replace the AC compressor is calculated by dividing the unit's hourly rate by the time it. Labor cost to replace AC compressor can range from $ to $1,, depending on location and type of compressor. Is It Cheaper To Replace Compressor Or Whole. On average, owners can expect to spend between $ and $ for a complete compressor replacement. This estimate includes both parts, typically priced between. Replacing your AC compressor typically costs between $ and $2,, varying with the unit's size, plus an additional $ to $ for professional. Cost of Labor HVAC companies may charge between $ and $ per hour for services like condenser repair or replacement. Installing a new AC condenser. How Much to Diagnose a Car AC Problem? · A/C Repair – $ to $ · A/C Compressor Replacement – $1, to $1, · A/C Recharge – $ to $ Replacing the air compressor could cost between $1,$3, on average, including labor costs. However, these figures may be different based on several. AC Compressor Installation Cost You will also incur labor cost or a diagnostic fee unless the compressor is under warranty. A diagnostic fee ranges between Labor Costs For AC Compressor Replacement. The labor expense to replace the AC compressor is calculated by dividing the unit's hourly rate by the time it. Overall, HomeAdvisor reports that the national average cost for replacing your AC compressor is about $1, Keep in mind the brand you have, the size of your. The average cost for a Chevrolet Silverado AC Compressor Replacement is between $ and $ Labor costs are estimated between $ and $ while parts. Labor Costs. Air conditioner compressor replacement and repairs typically require professional assistance. Installation costs usually make up 30% to 50% of the. How Much to Diagnose a Car AC Problem? · A/C Repair – $ to $ · A/C Compressor Replacement – $1, to $1, · A/C Recharge – $ to $ Car AC Compressor Replacement Service · On average, the cost for a Mini Cooper Car AC Compressor Replacement is $ with $ for parts and $ for labor. The average AC Compressor lasts about 10 years. Depending on your system and its age, a new air conditioning compressor can range from $ - $ The average AC Compressor lasts about 10 years. Depending on your system and its age, a new air conditioning compressor can range from $ - $ If your unit is under warranty, an AC compressor replacement can cost $ to $1, If it's not under warranty the replacement can cost anywhere from. If your unit is under warranty, an AC compressor replacement can cost $ to $1, If it's not under warranty the replacement can cost anywhere from. You need to consider the cost of replacing an AC unit and a compressor as well. Depending on the speed of the compressor and the size of the air conditioning.

Cd Rates Over 3

Best jumbo CD rates for years ; 3 years, Credit One Bank, % ; 3 years, Navy Federal Credit Union, % ; 4 years, SchoolsFirst Federal Credit Union, %. Lock in a great rate and peace of mind. Enjoy earning a fixed interest rate for the term you select, from 3 months to 5 years. Annual Percentage Yields (APYs). Compare rates on 3 year CDs from banks and credit unions. Use the filter box below to customize your results. Also, try our Early Withdrawal Penalty Calculator. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. For instance, a month CD will pay the same interest rate in the first month as it does in the twelfth month. This is in contrast to most savings accounts. Interest rates are fixed for the entire CD term. There's no charge to open months. Early withdrawal penalty. days: 1% of principal. Fremont Bank CDs combine the security of a fixed interest rate with a variety of CD terms to choose from. They're a high-yield, low-risk way to save. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. Best jumbo CD rates for years ; 3 years, Credit One Bank, % ; 3 years, Navy Federal Credit Union, % ; 4 years, SchoolsFirst Federal Credit Union, %. Lock in a great rate and peace of mind. Enjoy earning a fixed interest rate for the term you select, from 3 months to 5 years. Annual Percentage Yields (APYs). Compare rates on 3 year CDs from banks and credit unions. Use the filter box below to customize your results. Also, try our Early Withdrawal Penalty Calculator. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. For instance, a month CD will pay the same interest rate in the first month as it does in the twelfth month. This is in contrast to most savings accounts. Interest rates are fixed for the entire CD term. There's no charge to open months. Early withdrawal penalty. days: 1% of principal. Fremont Bank CDs combine the security of a fixed interest rate with a variety of CD terms to choose from. They're a high-yield, low-risk way to save. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %.

Certificate of Deposit Rates ; 5 Month Raise Your Rate CD Minimum to Obtain: $, % ; 5 Month New Money CD Special Minimum to Obtain: $, % ; 19 Month. Current 3-year CD rates · LendingClub Bank — % APY · First Internet Bank of Indiana — % APY · America First Credit Union — % APY · SchoolsFirst Federal. 3 years, 5 years. Annual Percentage Yield. %. Learn more Open Account. Choose from a variety of terms each offering a competitive, fixed rate. Early. Flexible terms from 3 to 60 months · Available in any amount from $ · Interest can be paid monthly as a transfer into your existing savings or checking account. Currently, the best CD rates range from percent APY to percent APY. This top rate is offered by America First Credit Union for a 3-month term, and. The Marcus 3-Year High-Yield CD rate is % Annual Percentage Yield. The Marcus 3-Year CD matures after 3 years and is an option for those seeking medium-term. Current CD Rates. CD TERM, $1,$24,, $25,$,, $, and over. 5-Month, % APY*. The average national deposit rate for a three-year CD is % APY (as of August 19, ). While the Fed may continue raising the interest rate for a little. % APY 3-MONTH CD · Social Security Number and date-of-birth, for yourself and a joint account owner if you choose to have one · Basic contact information. Personal CD Rates ; 18 month, %, % ; 2 year, %, % ; 3 year, %, % ; 4 year, %, %. Personal CD Rates ; 18 month, %, % ; 2 year, %, % ; 3 year, %, % ; 4 year, %, %. Best 3-Year CDs September · American 1 Credit Union. APY: %. Minimum Balance: $ · The Federal Savings Bank. APY: % · NexBank. APY: % · Lafayette. 3 Month CD Rates ; First Federal Lakewood. 3 Month CD Special - New Money. (2 Reviews). % ; Desert Rivers Credit Union. 1 Month Super CD. (0 Reviews). At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. The best nationwide 1-year CD rate in Oct. was % APY. But after 11 Fed rate hikes between March and July , the top 1-year rate has surged. %. Apply in a branch. Annual Percentage Yield (APY) accurate as of 09/06/ $ minimum deposit required to open a CD with a term of 3 months or. After that the CD rates declined steadily. In late , just before the economy spiraled downward, they were at around 4%. In comparison, the average one-year. APYs on fixed rate CDs stay the same throughout the term, so your money will grow consistently — regardless of changing interest rates. Easy account management. rate and APY then in effect for standard CD accounts. The 3-Month Promotional CD will automatically renew into a standard 3-Month CD account. Please see. These CDs are eligible for our Member Saver Reward1. Effective August 6, Term Length, Interest Rate3, APY4. 6.

How To Begin Forex Trading

How to start forex trading? · Step 1: Understand the Basics of Forex Trading · Step 2: Choose a Forex Broker · Step 3: Open a Demo Account · Step 4: Learn How. The minimum capital to start day trading forex can be as little as $ In addition, most forex brokers offer a margin account, which allows you to borrow money. Forex trading steps · 1. Decide how you'd like to trade forex · 2. Learn how the forex market works · 3. Open a tastyfx trading account · 4. BUILD A TRADING PLAN · 5. The app is a good starting tool because you are taught the basics of trading but they don't give you the strategies on how to trade on the market they give you. You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night (Sunday through Friday). Learning Forex Trading Basics · Opening an Online Forex Brokerage Account · Starting Trading. It is important to begin trading with a clear plan and a disciplined approach, while managing risk appropriately to avoid significant losses. Forex trading is short for foreign exchange, often called 'FX' and focuses on the exchange of one currency for another. 2. How to Become a Forex Trader & Build. Forex trading steps · Choose a currency pair to trade · Decide whether to 'buy' or 'sell' · Set your stops and limits · Open your first trade · Monitor your position. How to start forex trading? · Step 1: Understand the Basics of Forex Trading · Step 2: Choose a Forex Broker · Step 3: Open a Demo Account · Step 4: Learn How. The minimum capital to start day trading forex can be as little as $ In addition, most forex brokers offer a margin account, which allows you to borrow money. Forex trading steps · 1. Decide how you'd like to trade forex · 2. Learn how the forex market works · 3. Open a tastyfx trading account · 4. BUILD A TRADING PLAN · 5. The app is a good starting tool because you are taught the basics of trading but they don't give you the strategies on how to trade on the market they give you. You can now make trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night (Sunday through Friday). Learning Forex Trading Basics · Opening an Online Forex Brokerage Account · Starting Trading. It is important to begin trading with a clear plan and a disciplined approach, while managing risk appropriately to avoid significant losses. Forex trading is short for foreign exchange, often called 'FX' and focuses on the exchange of one currency for another. 2. How to Become a Forex Trader & Build. Forex trading steps · Choose a currency pair to trade · Decide whether to 'buy' or 'sell' · Set your stops and limits · Open your first trade · Monitor your position.

It's possible to apply to trade futures and forex through a client's boxblog.ru account. Understanding the quote. Trading the forex market involves trading two. Nowadays, it is possible to start trading forex with small amounts of money - even as low as $ However, you need to understand the limits of starting with a. When you're just starting out as a trader, it's essential to keep things simple. Focus on one or two strategies at a time. That way, you can use the rest of. If you're looking to get started as an individual trader, you'll need to do some research on forex trading platforms for retail investors and open an account. Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4: Open a Trading Account · Step 5: Prepare a. Answer - You can start trading with as little as $10 or invest more, like $, $1,, or even $15, Higher investments can potentially lead. Educate Yourself: Gain a solid understanding of forex trading by studying the market, trading strategies, risk management, and fundamental and. Learn stock and forex trading in a friendly, risk-free trading simulator. ☆ Learn Faster. Trade Smarter. And have fun while learning about financial markets. How to invest or trade forex The basic idea behind investing or trading forex is quite straightforward. If you believe the value of a particular currency may. How to place a forex trade · Step 1: Decide on your FX pair to trade · Step 2: Log into platform and select your chosen FX pair · Step 3: Review in-depth details. Follow all the steps listed in this article. I will also be revealing an easy-to-grasp strategy that you can jumpstart your trading with. It is possible to begin Forex trading with as little as $10 and, in certain cases, even less. Brokers require $1, minimum account balance requirements. Some. Trading forex · Going long on forex · Shorting forex · What is a pip? · Forex and leverage · Currency pairs · What moves forex markets? · Making your first forex trade. To start Forex trading as a beginner, first, educate yourself on the basics of the foreign exchange market. Learn about currency pairs, market. HOW TO START FOREX TRADING · Learn about the forex world: · Establish a brokerage account: · Create a trading strategy: · Maintaining a vigilant eye on your. As a beginner, it's advisable to initiate your trading journey with small position sizes while you become familiar with the market's nuances. Over time, as you. Learn everything you need to know to start Trading on the Forex Market today! In this course, I will show you how you can get started in Forex Trading. We. These brokers will offer you peace of mind as they will always prioritise the protection of your funds. Once you open an active account, you can start trading. As a beginner, you've taken your first steps towards learning the basics of forex trading. But it only gets harder from here. Just like learning how to walk.

How Long Can You Finance A Used Semi Truck

The financing period is the total duration over which the loan will be repaid, typically expressed in months (i.e., 12 to 60+ months). Where can I find the. We finance semi truck loans for commercial trucks of any size and age. Our used commercial truck financing is also an option if you are thinking of purchasing a. Repayment terms can range from 12 to 60 months, but may be longer, depending on the type of commercial truck. Payments are usually made on a monthly basis, and. Unsure how to calculate lease or loan payments for your truck purchase? International Used Truck Center 's semi-truck payment calculator makes the process. Commercial & Semi Truck Financing in AK, AZ, CA, OR, & WA. If you're considering financing your new truck, you're in good hands with our finance department. Let. Through TLG Financial, we provide the best in-house semi truck financing rates in the industry along with unmatched customer service you can trust. We've already noted that well-established credit history and two to three years of LLC status help qualify for a semi–truck loan. There are other ways in which. Typically loans run from six to 72 months (that's six years). What paperwork do you need for a commercial loan? When you work with TEC Finance, all we need is a. Flexible terms · Borrow up to $, per truck loan · Low competitive rates · Terms up to 72 months. The financing period is the total duration over which the loan will be repaid, typically expressed in months (i.e., 12 to 60+ months). Where can I find the. We finance semi truck loans for commercial trucks of any size and age. Our used commercial truck financing is also an option if you are thinking of purchasing a. Repayment terms can range from 12 to 60 months, but may be longer, depending on the type of commercial truck. Payments are usually made on a monthly basis, and. Unsure how to calculate lease or loan payments for your truck purchase? International Used Truck Center 's semi-truck payment calculator makes the process. Commercial & Semi Truck Financing in AK, AZ, CA, OR, & WA. If you're considering financing your new truck, you're in good hands with our finance department. Let. Through TLG Financial, we provide the best in-house semi truck financing rates in the industry along with unmatched customer service you can trust. We've already noted that well-established credit history and two to three years of LLC status help qualify for a semi–truck loan. There are other ways in which. Typically loans run from six to 72 months (that's six years). What paperwork do you need for a commercial loan? When you work with TEC Finance, all we need is a. Flexible terms · Borrow up to $, per truck loan · Low competitive rates · Terms up to 72 months.

The good news is that as you start to make your monthly used truck payments in a timely fashion, your credit score will improve. When it comes time for a loan. If you are asking how to get a loan for a semi truck or other commercial vehicle, read our 5 simple steps and requirements for financing. Loan and lease options to help meet your commercial vehicle needs · Financing and refinancing of new and used equipment · Terms from 12 to 84 months · Competitive. In a hurry? Our finance department can work with you on an expedited semi-truck financing plan so you can get back to work as soon as possible! Stop by our. We prefer to finance used trucks that have lower mileage → , Miles: 5 to 7 years term. If This Semi-Truck Finance Fits You, Pre-Qualify Below. This leasing option allows trucking businesses to acquire new or used trucks without having their credit scrutinized, making it an ideal choice for those with. Typically loans run from six to 72 months (that's six years). What paperwork do you need for a commercial loan? When you work with TEC Finance, all we need is a. Good advice but if you don't have a modern truck in the next year then you are chasing money until it's paid off and won't be able to compete. National Truck Loans has been considered the best semi-truck loan company for every type of individual looking for support. We provide semi truck loans for bad. The good news is that as you start to make your monthly used truck payments in a timely fashion, your credit score will improve. When it comes time for a loan. We prefer to finance used trucks that have lower mileage under , miles and less than 5 years of age. Some approval considerations will be given depending. How long can I finance equipment? We offer heavy equipment financing for up to 60 months. Our average term length being 48 months. Do you have financing. Commercial truck financing provides you with cash that you can use to buy one or more new or used semi trucks. This type of loan is referred to as a secured. Unsure how to calculate lease or loan payments for your truck purchase? International Used Truck Center 's semi-truck payment calculator makes the process. National Truck Loans has been considered the best semi-truck loan company for every type of individual looking for support. We provide semi truck loans for bad. If the answer here is anything less than 2 years you'll probably want to consider a lease option, a business loan, or if you have the cash, buying new or used. The finance managers have access to a wide variety of lending institutions that provide financing options for most credit profiles. They will work with you to. We specialize in Heavy truck and trailer lease financing on new and used heavy equipment. If you are buying from a vendor or privately, Alberta Truck & Trailer. At Pedigree Truck and Trailer Sales, we can help you quickly and securely pre-qualify for a loan or lease. All you need to do is follow the link below and fill. If the answer here is anything less than 2 years you'll probably want to consider a lease option, a business loan, or if you have the cash, buying new or used.